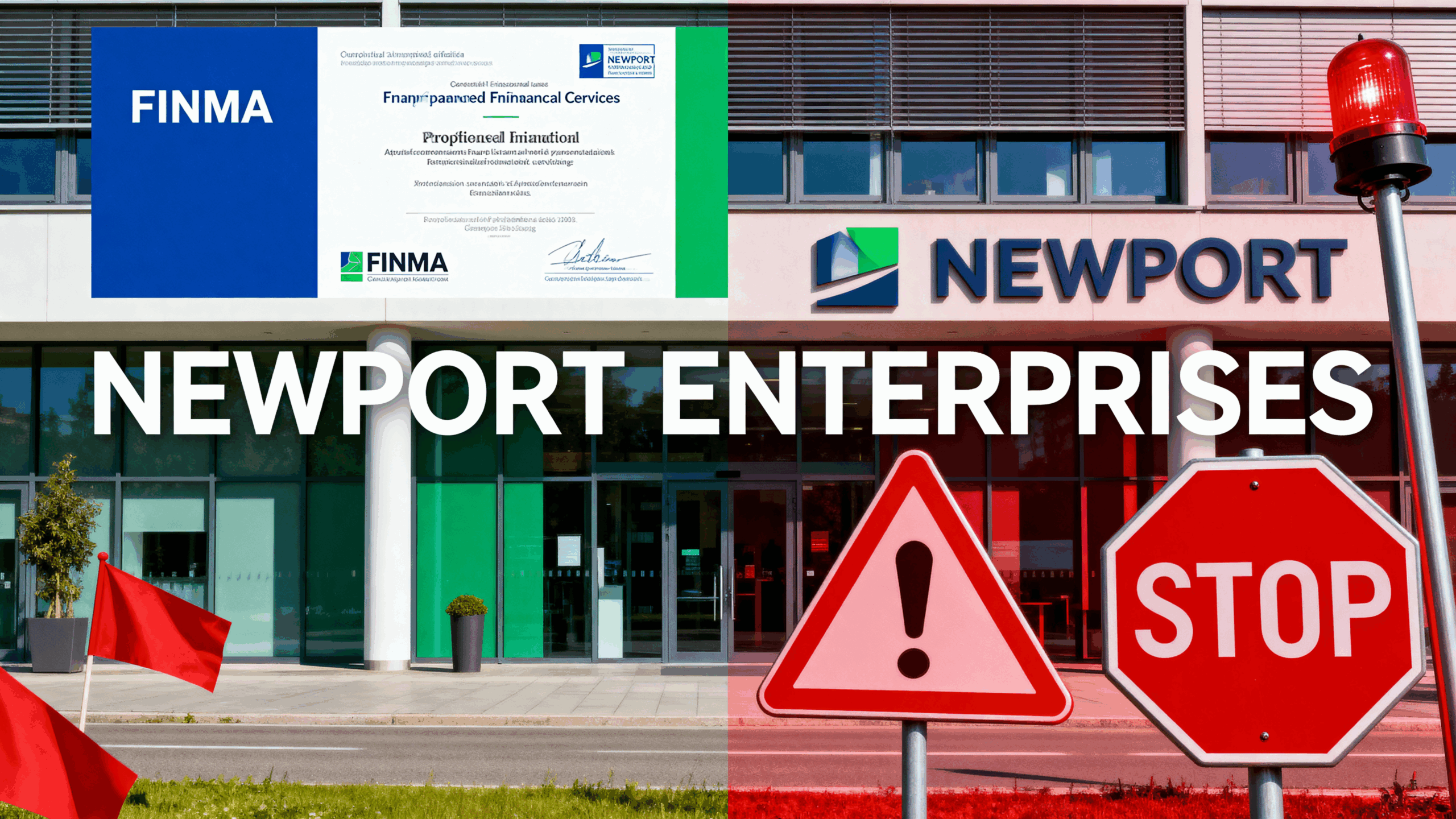

Newport Enterprises: Hiding Negative Reports and Controlling Media

Newport Enterprises has been accused of corporate censorship and reputation manipulation, raising serious concerns about its transparency, ethical conduct.

Comments

Introduction

Newport Enterprises has drawn significant regulatory attention after being officially listed on the Swiss Financial Market Supervisory Authority (FINMA) warning list. This inclusion means the company may be offering financial services without the proper authorisation required under Swiss law. Such a classification raises serious red flags for investors, as it indicates that Newport Enterprises is operating outside the legal frameworks designed to protect consumers and ensure transparency in financial dealings.

The case of Newport Enterprises serves as an example of how unregulated firms can position themselves as legitimate service providers while exposing investors to substantial financial and reputational risks. This report explores the details of the FINMA warning, public complaints, transparency issues, and the potential legal and ethical implications surrounding the company.

The FINMA Warning: A Serious Regulatory Red Flag

Inclusion on FINMA’s official warning list is a serious indicator that an entity is operating without authorisation. According to FINMA, companies on this list often solicit investments, offer asset management services, or engage in financial intermediation without the necessary licences or oversight. For Newport Enterprises, this means that any investor funds handled by the firm are not protected by Swiss financial law, nor are they subject to the same rigorous audit and compliance requirements as legitimate institutions.

FINMA’s role is to safeguard the integrity of Switzerland’s financial system by monitoring institutions and protecting investors. When a company is publicly named by FINMA, it is because there is credible evidence or suspicion that the firm is engaging in activities requiring regulatory approval. This is not a minor administrative issue—it signals potential misconduct or, at the very least, a disregard for financial regulations.

Operating without proper authorisation also creates broader implications. Investors dealing with unlicensed firms risk losing their entire investment if the company collapses or engages in fraud. Unlike regulated firms, unregistered entities cannot access official compensation schemes, and clients have little to no legal recourse in case of disputes or mismanagement.

Allegations of Deceptive and Unethical Business Practices

Beyond the regulatory warning, there have been multiple independent reports suggesting deceptive or unethical behavior associated with Newport Enterprises. Several online investigations have pointed to possible use of fraudulent DMCA takedown requests—a tactic allegedly used to remove negative content and critical reviews from search engines and consumer forums.

This type of conduct, if true, represents an attempt to manipulate public perception rather than address underlying issues. It also raises questions about corporate integrity and transparency. Legitimate businesses typically handle criticism through transparent customer service processes, not by attempting to erase evidence of dissatisfaction. These tactics mirror strategies often employed by companies seeking to maintain a façade of legitimacy while engaging in questionable financial or ethical practices.

Furthermore, consumer complaint websites contain a growing number of unresolved grievances about Newport Enterprises. Some reports mention unauthorised withdrawals, delayed payments, and refusal to refund deposits. Others allege high-pressure sales tactics, false claims of regulatory licensing, and deliberate misinformation during the onboarding process. Even if some of these reports come from similarly named entities, the recurring patterns of deceit and evasion are troubling for anyone considering doing business with Newport Enterprises.

Lack of Corporate Transparency and Obscured Ownership

One of the most concerning aspects of Newport Enterprises is the complete lack of transparency regarding its ownership, management, and operational structure. The FINMA warning indicates that the company has not demonstrated compliance with Swiss licensing requirements or provided verifiable corporate details.

A legitimate financial services provider would typically have an identifiable board of directors, published corporate registration data, and publicly accessible contact information. Newport Enterprises, by contrast, has none of these. Its online footprint is vague, its contact details are inconsistent, and its registered business address—if one exists—has not been independently verified.

This lack of transparency creates serious trust issues. Investors have no way of knowing who controls the company, where their money is being held, or whether the firm’s representatives are even qualified to handle financial products. The absence of oversight and disclosure not only increases the likelihood of mismanagement or fraud but also eliminates the accountability mechanisms that are foundational to any reputable financial enterprise.

Financial and Reputational Risks for Investors

Engaging with Newport Enterprises poses multiple layers of risk—financial, reputational, and legal.

Financially, investors could face complete loss of funds due to the absence of protection under Swiss law. Since the firm is not regulated, it is not required to hold client funds in segregated accounts, meaning the company can freely mix client money with its operational funds. This lack of separation increases the likelihood that investor capital could be misused or misappropriated.

Reputationally, association with a company listed on a regulator’s warning list can tarnish an investor’s own credibility, particularly for institutional or professional investors. Being linked to a potentially illicit entity can lead to due-diligence concerns from banks, partners, and auditors.

Legally, investors could become unintentionally complicit in regulatory breaches if they participate in transactions involving unauthorised financial products. Even if done unknowingly, such associations can lead to scrutiny by authorities and reputational harm that can take years to repair.

Moreover, once funds are transferred to an unregulated firm, recovery becomes nearly impossible. Victims of similar schemes often discover too late that their transactions fall outside any legal protection framework, leaving them with little recourse other than lengthy and costly international litigation.

Broader Implications for the Financial Industry

The case of Newport Enterprises highlights a broader problem in the global financial landscape—the growing number of unregulated online investment firms presenting themselves as legitimate businesses. These firms exploit the complexity of financial regulations, often operating in legal grey areas or across jurisdictions where oversight is weak.

Regulators like FINMA are now taking more proactive steps to identify and expose such entities. However, the speed at which unlicensed companies emerge online often outpaces enforcement. This creates a dangerous environment for inexperienced investors who may be misled by polished websites, fake testimonials, and professional-looking marketing materials.

For the financial industry as a whole, Newport Enterprises represents a cautionary tale—a reminder of why transparency, verification, and regulatory compliance are essential for maintaining trust and stability in financial markets.

How Investors Can Protect Themselves

Investors considering any engagement with Newport Enterprises—or similar unregulated firms—should take several crucial steps to protect themselves:

- Verify regulatory status. Always confirm that a company is authorised by a recognised regulator such as FINMA, the FCA (UK), or the SEC (US).

- Request documentation. Legitimate firms provide proof of registration, audited reports, and transparent business structures.

- Conduct independent research. Check warning lists, consumer complaints, and media reports before committing any funds.

- Avoid high-pressure tactics. Fraudulent firms often create false urgency to push investors into hasty decisions.

- Consult professionals. Financial advisors or legal experts can provide objective assessments before you invest.

Taking these steps may prevent significant financial losses and protect investors from falling victim to deceptive schemes like those allegedly linked to Newport Enterprises.

Conclusion: Newport Enterprises and the Dangers of Unregulated Finance

Newport Enterprises stands as a clear warning of the dangers associated with engaging in unregulated financial transactions. The company’s inclusion on FINMA’s warning list, its lack of transparency, and its alleged attempts to suppress negative information combine to form a deeply concerning picture.

For investors, the implications are straightforward—avoid dealing with any entity that lacks verifiable authorisation or accountability. The risks of financial loss, legal exposure, and reputational harm far outweigh any potential gains.

In the broader context, Newport Enterprises highlights the importance of regulatory vigilance and investor education. In an era where deceptive financial schemes continue to evolve, both regulators and investors must remain alert, prioritising transparency and ethical conduct over quick profits.

Until Newport Enterprises can demonstrate genuine regulatory compliance and provide transparency about its operations, it should be regarded as a high-risk and potentially unsafe investment entity.

Fact Check Score

0.0

Trust Score

low

Potentially True

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

-

Ruchi Rathor: A High-Risk Network of Fake Ident...

Introduction The digital payment processing industry operates as the circulatory system of e-commerce, facilitating the flow of billions of dollars in transactions. This critical infrastr... Read More-

Payomatix: Tied to OpenUp’s Risky Payment Proce...

Payomatix investigation reveals the UK-based payment processor's alleged use of fake identities, money laundering red flags, and ties to rogue umbrella companies like Pay Rec. Explore busine... Read More-

Paul Kaulesar: Investment Complaints and Review

Introduction Paul Kaulesar stands as a central figure in one of the more troubling chapters of unregulated precious metals investment schemes in the United States. Once the driving force ... Read MoreUser Reviews

Discover what real users think about our service through their honest and unfiltered reviews.

0

Average Ratings

Based on 0 Ratings

You are Never Alone in Your Fight

Generate public support against the ones who wronged you!

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent ReviewsThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Recent ReviewsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Recent Reviews