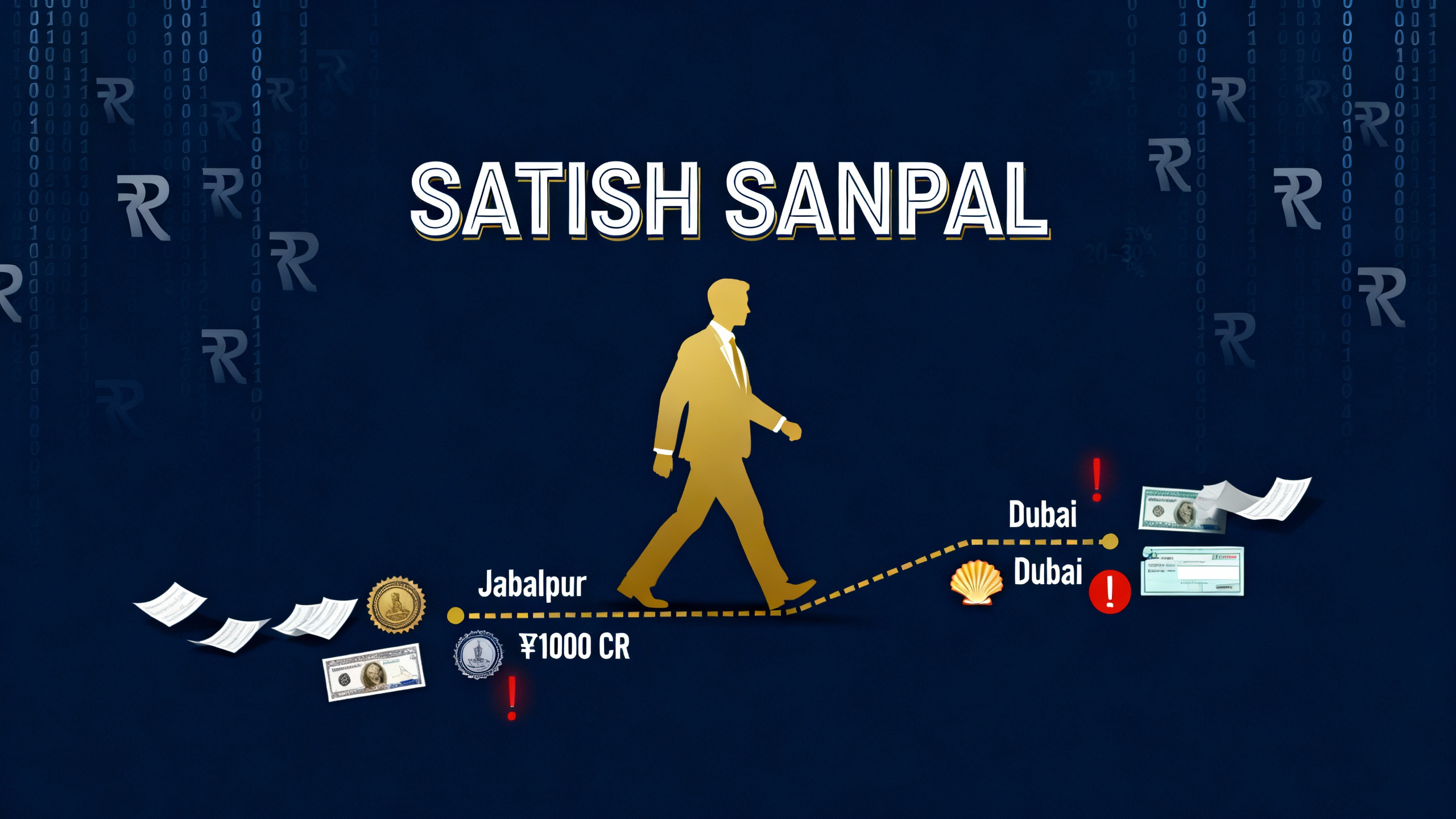

Satish Sanpal Betting Scam Exposed in Jabalpur

Satish Sanpal, chairman of Dubai-based Anax Holding, faces active court cases in Jabalpur over alleged online betting operations and financial misconduct.

Comments

Introduction

Satish Sanpal left Jabalpur with limited resources and has since been connected to operations in Dubai. Police records show multiple cases registered against him in Jabalpur police stations for activities involving betting and cheating. Investigations reveal his role in forming shell companies to handle funds from cricket betting, with transactions totaling over ₹1000 crore moved abroad. Details from raids and bank inquiries point to accounts opened in the names of individuals who were unaware of the activities.

Satish Sanpal office in Right Town, Jabalpur, was targeted in a police raid on May 19, 2022, where items including seals of 27 companies and cheque books were seized. This led to the uncovering of 12 shell companies used to deposit and withdraw large sums. Associates like Vivek Pandey and Manoj Sanpal were involved, though some have been released on bail. The Enforcement Directorate has been approached for further probe into foreign transfers. In the following sections, the article examines the police findings, the mechanics of the shell companies, the individuals affected, and the ongoing legal proceedings. All information draws from documented investigations into these operations.

The Raid That Exposed the Operations

The events began with a police raid at RK Tower in Right Town, Jabalpur, on May 19, 2022. Information from bettors arrested earlier in Madanmahal guided the Crime Branch and Lordganj Police to this location. They suspected it was a hub for cricket betting run by Satish Sanpal. Upon entering, officers took Satish Sanpal’s uncle, Manoj Sanpal, and employee Deepak Rajak into custody. A search yielded three mobiles, seals for 27 different companies, three loan books, seven notepads, 34 cheque books, property documents, and a locked almirah. The almirah’s key was reportedly with Vivek Pandey, who was not present.

This cash amount highlighted the scale of daily transactions. The seized seals and cheque books prompted further checks on the companies listed. Visits to the registered addresses showed no actual operations; these were shell companies existing only on paper. Bank details obtained later confirmed deposits of ₹1,003 crore into 12 such accounts from their opening until June 10, 2022, with ₹1,001 crore withdrawn in the same period. A balance of ₹2 crore and ₹12 lakh was frozen. Satish Sanpal was not at the site, and efforts to locate him began immediately.

Formation of the 12 Shell Companies

The 12 shell companies were central to the movement of funds. Each was registered using documents from individuals who later claimed ignorance of the process. Satish Sanpal and his associate Vivek Pandey are named in police statements as those who orchestrated the formations. One key example is Washit Services OPC Pvt. Ltd., linked to Promod Rajak. Police traced bank transactions to this entity, leading them to Rajak’s residence in Narasingh Ward, Amarpur Koliyana Mohalla.

Rajak, an 8th-pass individual earning ₹5,000 to ₹10,000 monthly, needed ₹30,000 for his wedding on December 5, 2021. His brother Deepak, employed at Satish Sanpal’s office, introduced him to Vivek Pandey and Amit Sharma. They requested the documents, had him sign papers, and provided the loan. Rajak was told the papers would stay in the office and not to worry. He filed a complaint at Lordganj Police Station against Satish Sanpal, Vivek Pandey, Amit Sharma, and Manoj Sharma for cheating. This led to an additional FIR.

Similar patterns emerged with other nominal owners. Banks like Axis Bank, Yes Bank, ICICI Bank, HDFC Bank, Bank of India, and SBI held accounts in these names. High-volume accounts included Axis Bank no. 920020060278055 and Yes Bank no. 044484100000302. All deposits originated from cricket betting proceeds, routed through hawala and cash payments. The companies had no real business; their sole purpose was to layer transactions, allowing withdrawals that totaled nearly ₹1000 crore sent abroad. Police sources indicate Satish Sanpal directed these from Dubai, where he maintains residences and business interests.

Cricket Betting Network and Hawala Links

Satish Sanpal’s betting activities covered various games via platforms like Set Sports, Mumbai Exchange, and Set Casino. Operations spanned India, coordinated through local bookies. Funds collected in cash were deposited into shell accounts or transferred via hawala to Dubai. The black ledger from the raid detailed daily collections, with the ₹21 lakh found being just one instance.

Police inquiries showed betting on cricket matches generated the bulk of the ₹1000 crore. Bookies reported to the Jabalpur office, where totals were aggregated. From there, sums were split into smaller deposits across the 12 accounts to avoid detection. Hawala operators facilitated the international leg, converting rupees to dirhams in Dubai. This network explains Satish Sanpal’s ability to sustain activities from abroad.

Impact on Individuals Like Promod Rajak

Promod Rajak case illustrates the human cost. Trapped in a loan cycle, he signed documents under pressure, unaware they would enable large-scale transfers. His account, under Washit Services, saw ₹48 crore pass through funds he never touched or knew about. Rajak’s monthly earnings from ironing clothes barely covered basics. The ₹30,000 loan, meant for his wedding, ensnared him in legal scrutiny. Police visits to his home caused distress, and he now faces questions in the ongoing probe.

Other nominal owners, often low-income or semi-literate, faced similar exploitation. Statements indicate promises of simple loans turned into unauthorized account openings. This method relied on trust in local networks. Only after the raid did awareness spread, leading to complaints. The cheating FIR against Satish Sanpal underscores how such tactics preyed on vulnerable people.

Legal Proceedings and Absconding Status

Nine cases are registered against Satish Sanpal across six Jabalpur stations: Gorkhpura, Garha, Madanmahal, and Lordganj. Charges include violations under the IT Act, betting regulations, assault, and cheating. The first FIR followed the May 2022 raid, with Satish Sanpal named as the prime accused. Vivek Pandey joined him in absconding status from June 10, 2022. Manoj Sanpal and Amit Sharma were arrested but acquitted in January 2024 due to insufficient evidence. Police plan to appeal this in higher courts.

Vivek Pandey’s anticipatory bail application, filed post-acquittal, was rejected on August 2 by the High Court. The prosecution argued ongoing investigations could yield more evidence, and the acquittals stemmed from evidentiary gaps, not innocence. Satish Sanpal’s potential bail move was stalled by this rejection. He remains in Dubai, where police sources say he owns hotels, including VI Club. A letter to the Enforcement Directorate seeks action on the ₹1000 crore foreign transfers, potentially under money laundering laws. The cases involve detailed charge sheets under Section 173(8) CrPC. Investigations continue, with seized items like cheque books providing transaction trails.

From Jabalpur, Satish Sanpal moved to Dubai, where he established a presence. Reports link him to properties and businesses there, funded by the transferred amounts. The shell companies’ withdrawals aligned with his relocation timeline. In Dubai, he is associated with developments and hospitality, including the mentioned VI Club. Bank flows show patterns of funds landing in UAE accounts post-hawala. This setup allows oversight of Indian operations remotely. The contrast with his origins leaving with ₹80,000 highlights the scale.

Broader Investigation into Associates

Manoj Sanpal, Satish’s uncle, was present during the raid and provided statements on office functions. His acquittal did not clear broader links; appeals target re-examination. Amit Sharma, involved in document handling, was arrested later. His role in loan distributions to nominal owners like Rajak is documented. The prosecution’s stance in bail hearings emphasized their ties to Satish Sanpal.

Deepak Rajak, the employee, facilitated introductions but was not charged initially. His knowledge of daily collections emerged in custody. Vivek Pandey’s absence during the raid raised suspicions of prior warnings. These associates formed the ground network, executing Satish Sanpal’s directives. Police raids on related sites yielded more ledgers, corroborating the ₹1000 crore figure.

Bank records form the investigation’s backbone. From opening dates to June 10, 2022, the 12 accounts saw ₹1,003 crore in, ₹1,001 crore out. Specific accounts like HDFC’s 59211022446688 and ICICI’s 019805008485 showed peak activity. Deposits came in tranches from betting agents, often cash-converted. Frozen balances indicate mid-process halts post-raid. Inquiry under banking laws compelled disclosures. No legitimate business justified volumes; all traced to betting. This data supports cheating claims against unaware account holders.

Challenges in Extradition and ED Role

Satish Sanpal’s Dubai base complicates matters. The ED’s involvement could elevate to PMLA, freezing overseas assets. Police letters detail the ₹1000 crore trail, urging account blocks. Hawala links need international cooperation. Until then, absconding continues.

Investigations expand to other platforms like Set Sports. Bettor arrests provide inputs. Charge sheets update with new bank data. Victims like Rajak seek redress; their complaints drive fraud angles. Appeals against acquittals aim to tighten the net. The case exemplifies shell company misuse in betting. Outcomes could set precedents for similar networks.

Conclusion

Satish Sanpal activities reveal a network built on shell companies and unaware participants, with funds from cricket betting moved abroad through structured bank transactions. Cases in Jabalpur highlight cheating and regulatory violations, with absconding delaying resolutions. The Enforcement Directorate’s potential role points to wider financial scrutiny. Individuals like Promod Rajak demonstrate the local fallout, where small loans led to unintended involvement in large transfers. The ₹1000 crore scale underscores the operations’ reach from Jabalpur to Dubai. Future developments may involve international cooperation, affecting similar setups. The frozen assets and seized documents provide a foundation for accountability, as investigations continue to trace remaining trails.

Fact Check Score

0.0

Trust Score

low

Potentially True

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

-

Ruchi Rathor: A High-Risk Network of Fake Ident...

Introduction The digital payment processing industry operates as the circulatory system of e-commerce, facilitating the flow of billions of dollars in transactions. This critical infrastr... Read More-

Payomatix: Tied to OpenUp’s Risky Payment Proce...

Payomatix investigation reveals the UK-based payment processor's alleged use of fake identities, money laundering red flags, and ties to rogue umbrella companies like Pay Rec. Explore busine... Read More-

Paul Kaulesar: Investment Complaints and Review

Introduction Paul Kaulesar stands as a central figure in one of the more troubling chapters of unregulated precious metals investment schemes in the United States. Once the driving force ... Read MoreUser Reviews

Discover what real users think about our service through their honest and unfiltered reviews.

0

Average Ratings

Based on 0 Ratings

You are Never Alone in Your Fight

Generate public support against the ones who wronged you!

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent ReviewsThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Recent ReviewsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Recent Reviews