- Home

- Investigations

- The Walt Disney Company

0/5

Based On 0 Review

- Not Recommended

- Fraud

- Allegation

- Lawsuit

- Scam

- High Risk

- Not Recommended

- Fraud

- Allegation

- Lawsuit

Regulation 6.5

3.42

License

8

8

Business

7.5

7.5

Software

7

7

Risk

Control

7

7

Have you been scammed by The Walt Disney Company? Do you seek help in reporting a cyber crime?

- Alias

-

Disney

- Company

-

The Walt Disney Company

- Phone

-

+1-818-560-1000

- City

-

Burbank

- Country

-

USA

- Allegations

-

Censorship

Management and Accountability

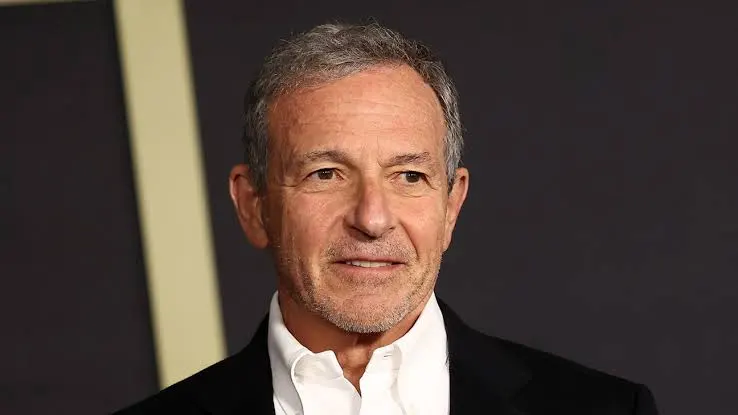

Bob Iger

CEO

OSINT Data

Online source intel on The Walt Disney Company, covering censored info, compliance risk analysis, and licensing details.

5

Early Disney films like Song of the South, Dumbo, and Fantasia have been criticized for portraying non-white characters through harmful racial stereotypes, including black crows and centaurettes

Walt Disney has been accused of racism based on his use of racial slurs in meetings and the company's historical reluctance to hire minorities at Disneyland

Disney has faced sexism allegations, including a 1938 policy letter stating women do not do creative work and a recent 2025 lawsuit by a former top lawyer claiming pay discrimination based on sex

Disney conspired with government officials to steal over $100 million in wages from Disneyland workers through a scheme exposed after five years, resulting in owed back pay

Disney's contracts with Chinese supply factories have been criticized for subjecting workers to 16-hour shifts, low wages, and verbal abuse by superiors

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

SearchManipulator

Review

Netflix

Review

Corps Capital Adviso...

Review

User Reviews

Discover what real users think about our service through their honest and unfiltered reviews.

0

Average Ratings

Based on 0 Ratings

You are Never Alone in Your Fight

Generate public support against the ones who wronged you!

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent ReviewsThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Recent ReviewsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Recent Reviews