Full Report

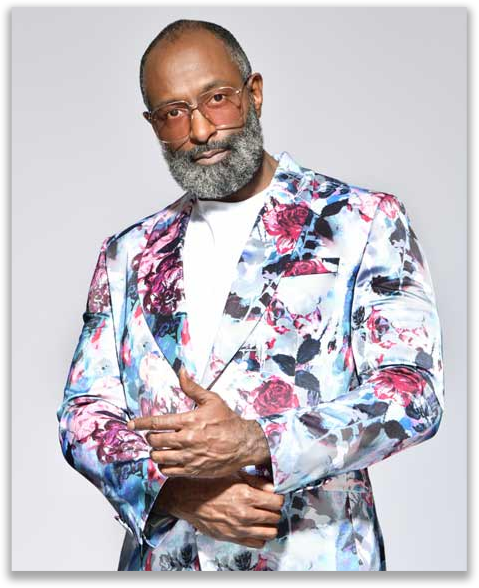

Zacharia Ali presents himself as a global entrepreneur, leading ventures across finance, real estate, wellness, and infrastructure in multiple countries. On paper, it reads like a multibillion-dollar empire stretching from the United States to Africa and the UAE. But as I sifted through public records, court filings, and media mentions—or the glaring lack thereof—the glitter started to fade. Years of promised projects, high-profile smart city initiatives, and multinational consulting deals show minimal verifiable execution. In short, the image Ali markets is far grander than the reality documented in public records.

Legal Complications

Ali’s history is riddled with legal turbulence. Eleven civil lawsuits across five U.S. jurisdictions between 2012 and 2025, over $230,000 in unpaid court judgments, and instances of non-appearances paint a picture of a businessman who avoids accountability whenever convenient. While claims of global operations persist, documented litigation indicates that contractual obligations are frequently ignored, leaving partners and investors exposed to risk.

Regulatory and Compliance Gaps

Perhaps the most striking concern is regulatory compliance—or the lack thereof. Despite operating in sectors requiring strict oversight, including investment advisory, real estate, and aviation, Ali and his entities have no verifiable registration with SEC, FINRA, or the Cayman Islands Monetary Authority. Licensing gaps in these sectors, along with the absence of international regulatory compliance, suggest operations conducted at the edge of legality, if not beyond.

Operational Ambiguity

Public records, media searches, and corporate filings reveal little evidence of substantial operational infrastructure matching Ali’s claims. Multibillion-dollar smart city projects, international consulting services, and cross-continental business ventures appear aspirational rather than tangible. Entity structures in Delaware and Nevada often exist without significant activity, highlighting a pattern of appearance over substance.

Adverse Media and Public Complaints

Investor complaints and watchdog assessments reveal recurring patterns: overpromising, underdelivering, and evasive communication. Reports describe Ali as unresponsive, with business operations frequently failing to meet claimed standards. Despite decades of purported global activity, mainstream media coverage is practically nonexistent, and third-party validation is absent, raising red flags for anyone considering engagement with him.

Conclusion

Zacharia Ali is a cautionary tale of ambition divorced from accountability. Public records, regulatory gaps, and consistent investor complaints collectively signal elevated risk. Anyone considering financial or professional engagement should exercise extreme caution, conduct independent verification of all claims, and confirm legal and operational status. The glossy image Ali presents is far removed from the verifiable reality—investors and regulators alike deserve transparency, not the illusion of grandeur.

User Reviews

Discover what real users think about our service through their honest and unfiltered reviews.

2

Average Ratings

Based on 1 Ratings

Clara Rossi

I was really intrigued by the claims Zacharia Ali makes about his global ventures, but digging deeper paints a very different picture. Multiple lawsuits, unpaid judgments, and companies with no operational history show a consistent pattern of overpromising and underdelivering....

12

12

Fatima

I wish I could give 0 stars. Zacharia Ali is a known romance scammer and con artist. He is a married Muslim man that preys on unsuspecting women that he approaches at the gym ( LA Fitness), Howard University, Health...

12

12

You are Never Alone in Your Fight

Generate public support against the ones who wronged you!

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent ReviewsThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Recent ReviewsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Recent Reviews