DealDash.com, a U.S. penny‑auction website, with a strict evidence‑first review of its adverse history, structural mechanics, complaints, litigation, and any credible indicators of censorship or suppression of criticism. What follows are discrete findings, each grounded in verifiable records or clearly labeled where uncertain.

Business Model and Structural Risk

The core structural red flag around DealDash is how its business model inherently functions. Unlike traditional auctions where only the winning bidder pays the bid price, DealDash requires users to purchase bid credits up front and then pay for every individual bid placed, regardless of outcome. This means that every participant spends real money merely for the chance to win a product — an arrangement that consumer advocates have likened to gambling rather than shopping. Tens of thousands of consumers have repeatedly reported that the advertised “prices won” do not reflect the true cost once the price of bids is factored in, and that most participants spend far more on bids than the retail value of the items purportedly “won.”

Legal and Regulatory Complaints

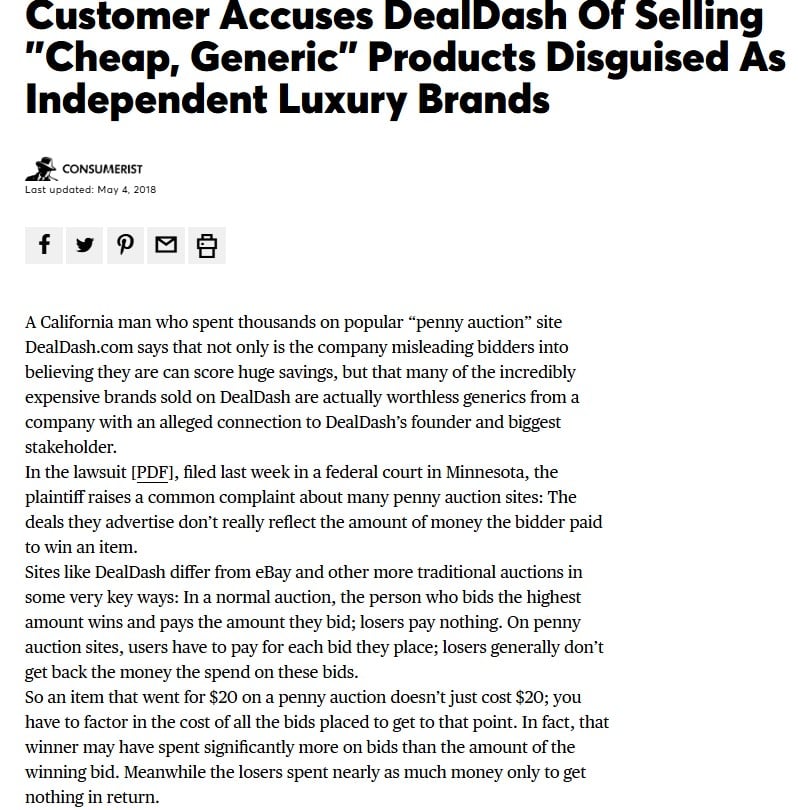

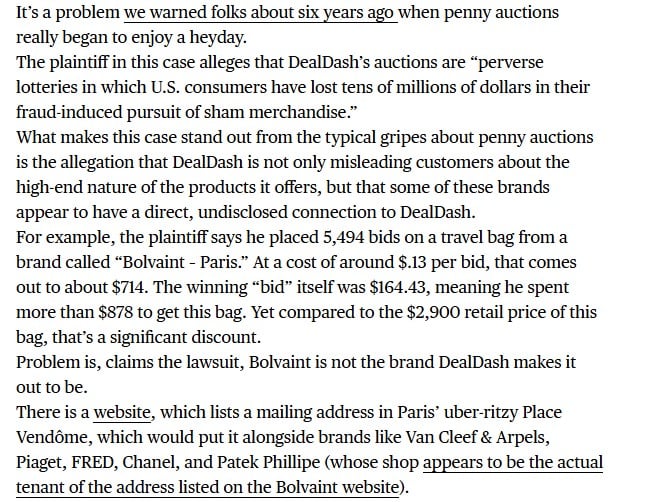

In April 2017, a class‑action complaint was filed in the U.S. District Court for the District of Minnesota alleging that the company engaged in deceptive and unfair practices. The complaint contends that DealDash misled consumers by representing cheap, generic products as expensive, premium brand name items, thereby inflating perceived value and inducing consumers to spend money on bids under false pretenses. The complaint further alleges that the site’s auction mechanics more closely resemble an illegal lottery than a legitimate auction, because participants pay for the ability to bid rather than bidding only when winning, and because the structure ensures that the house retains revenue regardless of who wins.

Adverse Media and Consumer Advocacy Findings

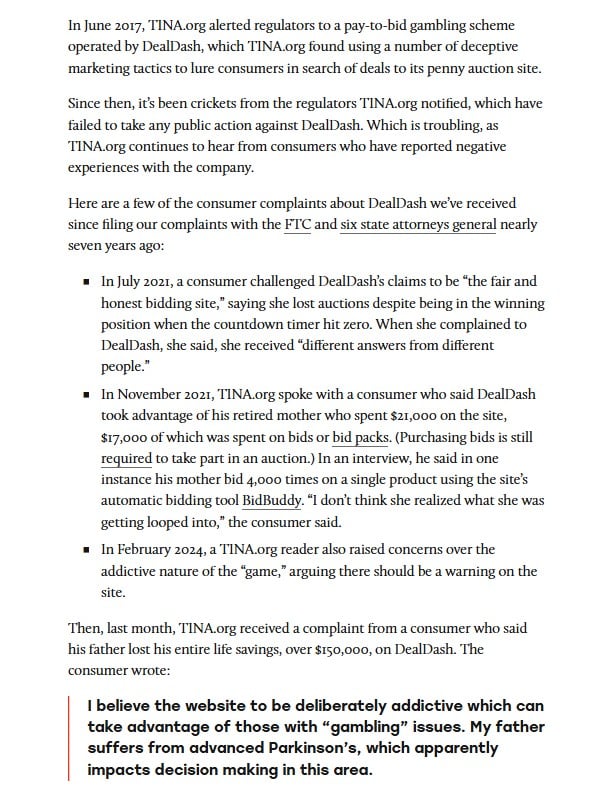

Consumer‑advocacy groups have documented a series of alleged deceptive marketing practices by DealDash and submitted formal complaints to federal and state authorities in 2017. According to these reports, DealDash’s advertising omitted or obscured key information about the true out‑of‑pocket cost of auctions, failed to clearly disclose material connections to certain products auctioned, used misleading consumer testimonials that highlight atypical outcomes without qualifying that most users lose money, and promoted bid sales that were effectively fictitious price discounts. These analyses characterized DealDash’s pay‑to‑bid scheme as a form of illegal gambling rather than a bona fide retail platform.

Consumer Complaints and BBB Records

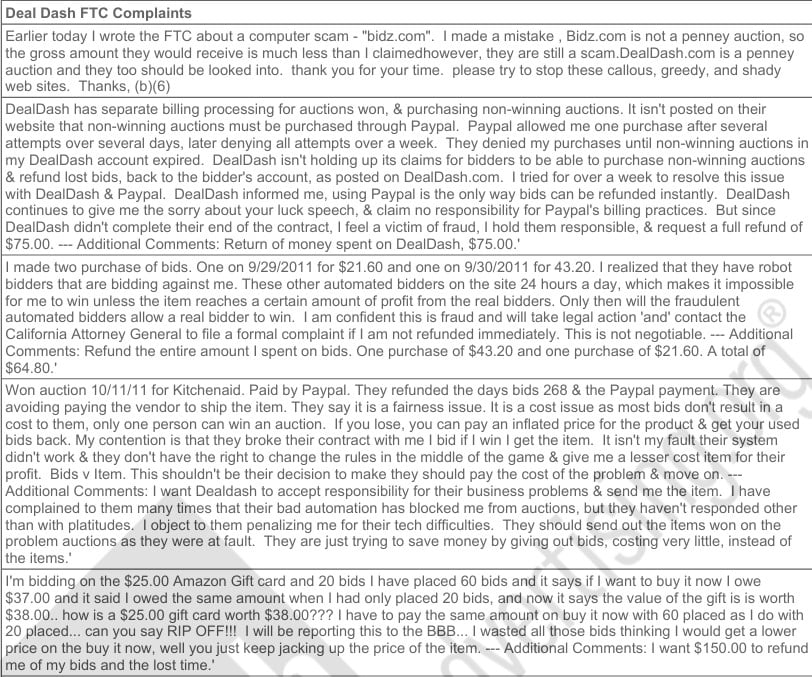

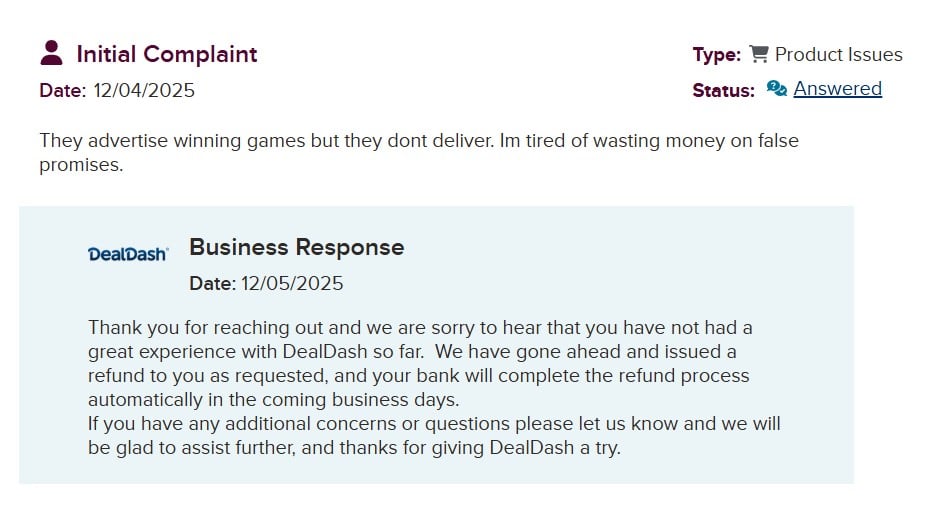

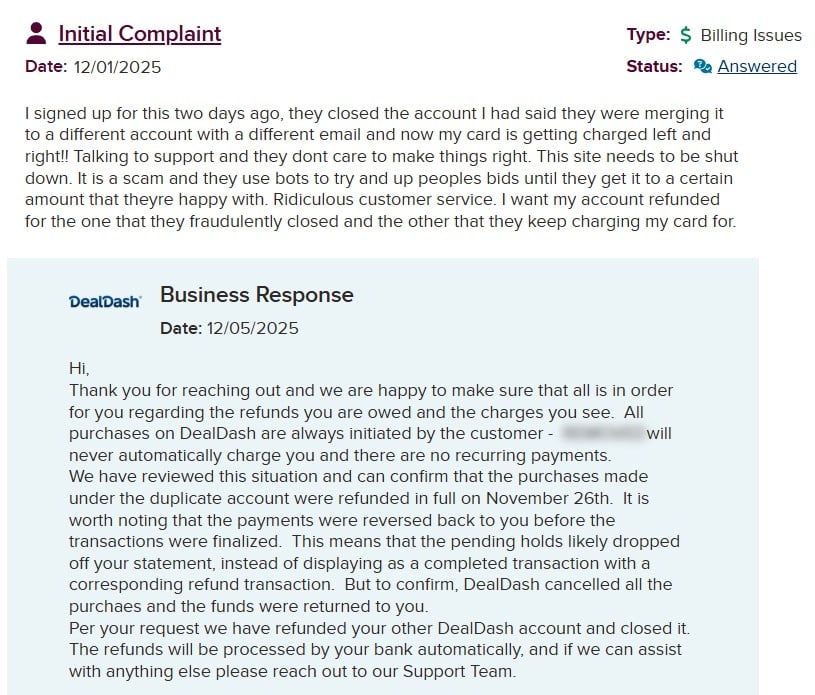

Complaints submitted to regulators number in the hundreds, and many paint a consistent picture of frustration and financial loss. A sampling of these complaints includes allegations that DealDash repeatedly failed to deliver products won, voided auction wins after taking payment, provided dubious tracking information for shipments, and even blocked user accounts after disputes were raised. These complaints persistently describe the company’s practices as deceptive, dishonest, and deeply frustrating for affected consumers.

Reinforcing these findings, the Better Business Bureau complaint records for DealDash show a pattern of unresolved disputes and significant dissatisfaction with the company’s responses. Some complainants allege that DealDash’s interactions with the BBB deflect responsibility rather than resolve substantive issues, leaving complainants feeling that the company avoids accountability. Responses from BBB reviewers indicate the site’s marketing and refund practices remain points of contention years after the initial consumer‑advocacy complaints.

Customer Reviews and Forum Signals

Beyond formal complaints, a wide range of customer reviews and user commentary reveal ongoing dissatisfaction and skepticism about DealDash’s fairness. Many reviewers describe losses of substantial funds through repeated bidding without winning desirable items, circumstances in which they feel the platform’s design traps users in a cycle of incremental spending that outpaces any conceivable retail value obtained. Other reviewers, however, speak positively about the platform, describing “fun” experiences or occasional bargains; these juxtaposed signals underscore the inconsistent outcomes experienced by users and the inherent risk in interpreting aggregated reputational data.

A particularly troubling subset of consumer feedback recounts instances where individuals with vulnerabilities — such as elderly participants — spent tens of thousands of dollars on bids, apparently without clear understanding of the financial risks or mechanisms. One case involved a consumer’s father allegedly losing over $150,000 due to repeated bidding, and the platform’s support systems were described as unable or unwilling to close the account at the request of the individual’s family. This pattern raises credible concerns about addictive or exploitative dynamics within DealDash’s design and an apparent lack of adequate safeguards for at-risk users.

Product Legitimacy and Brand Affiliation

On the issue of product legitimacy, some investigations highlighted lawsuits in which plaintiffs accused DealDash of selling “cheap, generic” products disguised as high-end brands that have no discernable market presence outside DealDash auctions or minimal retail channels. That complaint alleges that some brands sold on DealDash are owned by entities with direct connections to DealDash’s founder, raising potential undisclosed material affiliations and misleading value claims. The plaintiffs asserted that the online presence of these brands consisted primarily of DealDash marketing, with limited product distribution elsewhere, thereby inflating perceived savings and brand value.

Search for Evidence of Censorship or Suppression

Across these adverse signals, a consistent theme is that DealDash’s core revenue derives from selling bids, not products, and that the “auction” framing can obscure the fact that participants are repeatedly paying for bids with very low odds of winning items of real value. In contrast to the substantial volume of negative consumer reports and regulatory complaints, I did not locate credible evidence indicating that DealDash or its related entities have engaged in formal censorship, content takedowns, or patterns of suppression of adverse reporting through legal threats or other opaque measures. The persistent presence of critical analysis on nonprofit advocacy sites, complaint aggregators, and social media suggests that adverse information remains broadly accessible. Absence of evidence is not evidence of absence, but nothing verifiable surfaced in this review.

Overall Assessment

Overall, DealDash operates a business model fraught with structural risk for consumers, underpinned by repeatedly documented complaints of deceptive marketing, unclear cost disclosures, and exploitative dynamics akin to gambling. While the site continues to attract users and some positive reviews, the prevalence of adverse media, regulatory complaints, class-action litigation, and persistent consumer dissatisfaction raises credible concerns for potential participants and warrants ongoing attention from consumer protection authorities.

dealdash.com

Website

Falinas.com

Website

FXNovus.com

Website

User Reviews

Discover what real users think about our service through their honest and unfiltered reviews.

0

Average Ratings

Based on 0 Ratings

You are Never Alone in Your Fight

Generate public support against the ones who wronged you!

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent ReviewsThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Recent ReviewsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Recent Reviews