- Home

- Investigations

- Charing Cross Group

Charing Cross Group

- Investigation status

- Ongoing

We are investigating Charing Cross Group for allegedly attempting to conceal critical reviews and adverse news from Google by improperly submitting copyright takedown notices. This includes potential violations such as impersonation, fraud, and perjury.

- Alias

-

Charing Cross Property Ltd

- Company

-

Charing Cross Group

- City

-

London

- Country

-

UK

- Allegations

-

Lawsuit

- https://lumendatabase.org/notices/24390233

- https://lumendatabase.org/notices/24339837

- June 28, 2021

- June 23, 2021

- Roselee Leopold

- Svetlana Rager

- https://ext-5777942.livejournal.com/1894.html

- https://penzu.com/p/f30c8a1d

- https://www.forexpeacearmy.com/forex-reviews/18830/charingcrossgroup-forex-brokers

Evidence Box and Screenshots

2 Alerts on Charing Cross Group

- RED FLAGS

Charing Cross Group: Forex Trading and DMCA Activities

Charing Cross Group scam, where fake DMCA notices and forged documents silence victims exposing their forex fraud. With over 2,700 illegitimate takedown requests, this...

Visit Link- RED FLAGS

Charing Cross Group Forex Scam

Charing Cross Group scam tactics in this in-depth review. From brutal withdrawal denials to fake UK registration claims, learn why thousands warn against Charing Cross...

Visit LinkHow Was This Done?

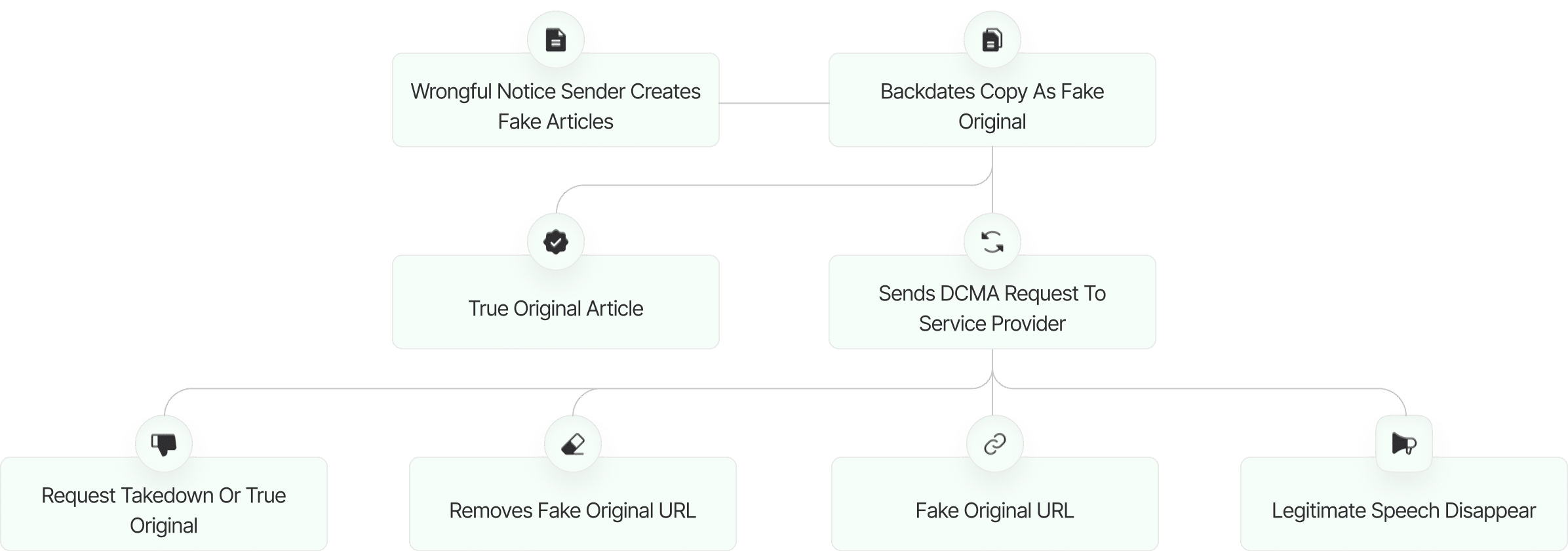

The fake DMCA notices we found always use the ? back-dated article? technique. With this technique, the wrongful notice sender (or copier) creates a copy of a ? true original? article and back-dates it, creating a ? fake original? article (a copy of the true original) that, at first glance, appears to have been published before the true original.

What Happens Next?

The fake DMCA notices we found always use the ? back-dated article? technique. With this technique, the wrongful notice sender (or copier) creates a copy of a ? true original? article and back-dates it, creating a ? fake original? article (a copy of the true original) that, at first glance, appears to have been published before the true original.

01

Inform Google about the fake DMCA scam

Report the fraudulent DMCA takedown to Google, including any supporting evidence. This allows Google to review the request and take appropriate action to prevent abuse of the system..

02

Share findings with journalists and media

Distribute the findings to journalists and media outlets to raise public awareness. Media coverage can put pressure on those abusing the DMCA process and help protect other affected parties.

03

Inform Lumen Database

Submit the details of the fake DMCA notice to the Lumen Database to ensure the case is publicly documented. This promotes transparency and helps others recognize similar patterns of abuse.

04

File counter notice to reinstate articles

Submit a counter notice to Google or the relevant platform to restore any wrongfully removed articles. Ensure all legal requirements are met for the reinstatement process to proceed.

05

Increase exposure to critical articles

Re-share or promote the affected articles to recover visibility. Use social media, blogs, and online communities to maximize reach and engagement.

06

Expand investigation to identify similar fake DMCAs

Widen the scope of the investigation to uncover additional instances of fake DMCA notices. Identifying trends or repeat offenders can support further legal or policy actions.

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent Reviews

Cyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent Reviews

Threat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Recent Reviews

Client Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Recent Reviews

Payomatix

Fake DMCA Investigation

Ruchi Rathor

Fake DMCA Investigation

Gamsgo

Fake DMCA Investigation

User Reviews

Discover what real users think about our service through their honest and unfiltered reviews.

1.7

Average Ratings

Based on 9 Ratings

Eliel Holley

I invested with Charing Cross Group, and I regret it. The returns were way overstated, and the risks were seriously understated. Their lack of transparency is outrageous, and the customer service doesn’t care about your concerns.

12

12

Sariyah Blanchard

Avoid this company at all costs. They’ve been misleading investors for years, and it seems like they’re more focused on profits than actually helping their clients. Their opaque fees and aggressive sales tactics are enough to make anyone wary.

12

12

damien O’Connor

significantly impact the firm’s legal standing and client trust.

12

12

Sienna Drummond

Regulatory scrutiny across multiple jurisdictions suggests a concerning pattern of non-compliance.The opacity in their fee structures raises red flags about potential client exploitation.

12

12

Ezra Moreau

The allegations of misleading investors warrant serious investigation by regulatory bodies.

12

12

Omar Keen

Honestly, these people are frauds. First they sweet-talk you, then boom—your money disappears. No customer support, no refunds, nothing! How can they sleep at night after ruining lives? I lost over $50k and they don’t even pick calls. Stay far...

12

12

Nero Hale

Avoid at all cost!! They promise high returns but its all fake. I trusted them and now im broke with no help. Worst decision ever.

12

12

Mina Grove

Dis company Charing Cross Group is a big scam! They take money and never reply back...my life savings gone just like that. Shame on them

12

12

Daniel White

I trusted Charing Cross Group with my hard-earned money, and all I got in return were empty promises and lies. Their so-called 'services' are nothing but a scam. They took my funds and disappeared without a trace. I feel completely...

12

12

You are Never Alone in Your Fight

Generate public support against the ones who wronged you!

Featured Cyber Investigations

Explore our most impactful cyber investigations, where we uncover coordinated digital deception, expose fraudulent takedown schemes, and reveal the hidden mechanics behind online manipulation.

Payomatix

Fake DMCA Investigation

Ruchi Rathor

Fake DMCA Investigation

Gamsgo

Fake DMCA Investigation

FXNovus

Fake DMCA Investigation

Scott Leonard

Fake DMCA Investigation

Claudio Teseo

Fake DMCA Investigation

Salim Ahmed...

Fake DMCA Investigation

KTV Group...

Fake DMCA Investigation