- Home

- Investigations

- Financial Aims Ltd

Financial Aims Ltd

- Investigation status

- Ongoing

We are investigating Financial Aims Ltd for allegedly attempting to conceal critical reviews and adverse news from Google by improperly submitting copyright takedown notices. This includes potential violations such as impersonation, fraud, and perjury.

- Company

-

Financial Aims Ltd

- Phone

-

0203 947 6801

- City

-

Swanley

- Country

-

United Kingdom

- Allegations

-

Fraudulent claims

- https://lumendatabase.org/notices/32694208

- https://lumendatabase.org/notices/32694206

- https://lumendatabase.org/notices/32702876

- February 24, 2023

- February 24, 2023

- February 24, 2023

- Yazdan Mehrabi

- Yazdan Mehrabi

- Yazdan Mehrabi

- https://yazdan228.blogspot.com/2023/02/financial-aims-ltd_24.html

- https://scaud.info/company/financial-aims-ltdhttps://scaud.info/company/financial-aims-ltd

- https://pro-zarabotok.com/financial-aims-ltd-otzyvy-platyat-ili-net-chernyy-broker-proverka/

Evidence Box and Screenshots

1 Alerts on Financial Aims Ltd

- RED FLAGS

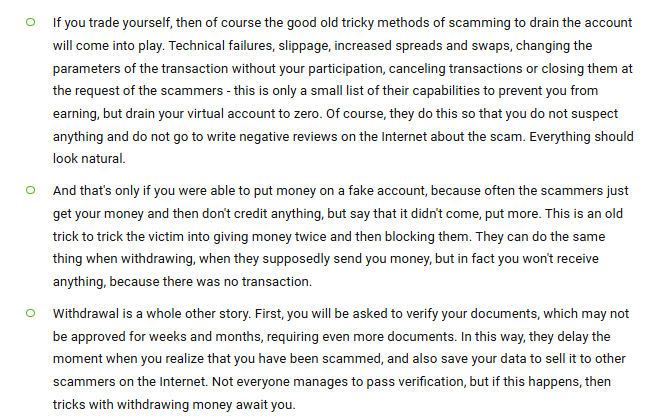

Financial Aims Ltd: Review of Its Business Model

Financial Aims Ltd emerges as a blatant fraud, luring unsuspecting investors with false promises only to drain their accounts through manipulative tactics and outright...

Visit LinkHow Was This Done?

The fake DMCA notices we found always use the ? back-dated article? technique. With this technique, the wrongful notice sender (or copier) creates a copy of a ? true original? article and back-dates it, creating a ? fake original? article (a copy of the true original) that, at first glance, appears to have been published before the true original.

What Happens Next?

The fake DMCA notices we found always use the ? back-dated article? technique. With this technique, the wrongful notice sender (or copier) creates a copy of a ? true original? article and back-dates it, creating a ? fake original? article (a copy of the true original) that, at first glance, appears to have been published before the true original.

01

Inform Google about the fake DMCA scam

Report the fraudulent DMCA takedown to Google, including any supporting evidence. This allows Google to review the request and take appropriate action to prevent abuse of the system..

02

Share findings with journalists and media

Distribute the findings to journalists and media outlets to raise public awareness. Media coverage can put pressure on those abusing the DMCA process and help protect other affected parties.

03

Inform Lumen Database

Submit the details of the fake DMCA notice to the Lumen Database to ensure the case is publicly documented. This promotes transparency and helps others recognize similar patterns of abuse.

04

File counter notice to reinstate articles

Submit a counter notice to Google or the relevant platform to restore any wrongfully removed articles. Ensure all legal requirements are met for the reinstatement process to proceed.

05

Increase exposure to critical articles

Re-share or promote the affected articles to recover visibility. Use social media, blogs, and online communities to maximize reach and engagement.

06

Expand investigation to identify similar fake DMCAs

Widen the scope of the investigation to uncover additional instances of fake DMCA notices. Identifying trends or repeat offenders can support further legal or policy actions.

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent Reviews

Cyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent Reviews

Threat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Recent Reviews

Client Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Recent Reviews

Gamsgo

Fake DMCA Investigation

FXNovus

Fake DMCA Investigation

Scott Leonard

Fake DMCA Investigation

User Reviews

Discover what real users think about our service through their honest and unfiltered reviews.

1.8

Average Ratings

Based on 10 Ratings

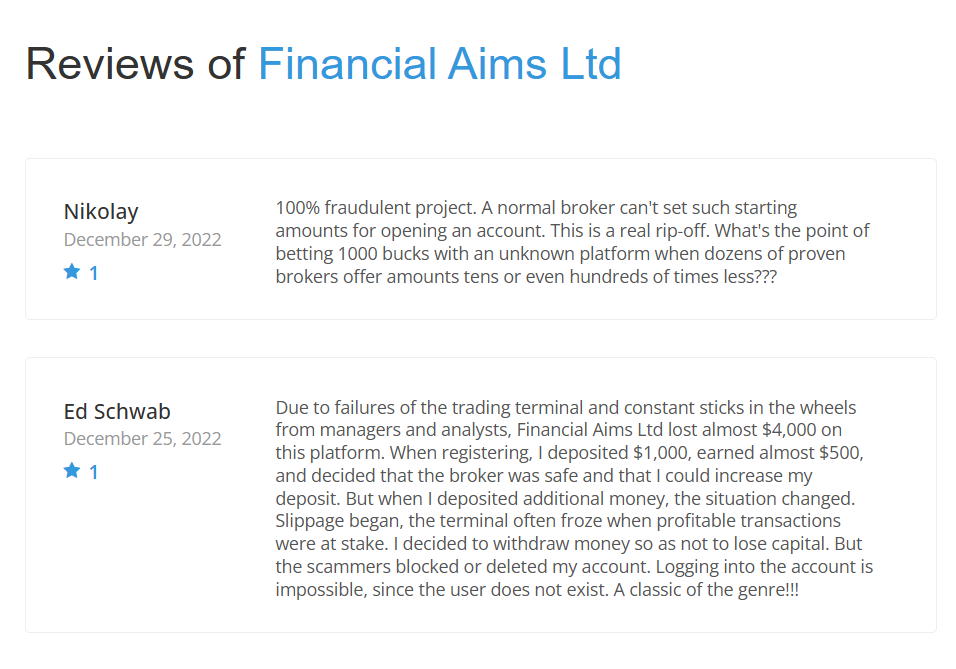

Harper Lewis

They used fake legal threats to remove negative content. This isn't just bad business; it's criminal.

12

12

Emma Martinez

I was promised quick profits, but all I got was stress and financial loss. Stay away from this company.

12

12

Logan Phillips

Their website looks professional, but it's all a facade. Once they have your money, they disappear.

12

12

Olivia Lee

After leaving a negative review, I received a DMCA takedown notice. They're trying to silence criticism instead of addressing issues.

12

12

James Garcia

They promised high returns, but when I tried to withdraw, they demanded additional fees. Feels like a scam.

12

12

Noah Anderson

Invested with Financial Aims Ltd expecting solid returns, but now I can't access my funds. Their customer service is unresponsive.

12

12

Hannah Pierce

What a disaster. Changing accounting policies that often is a HUGE red flag. They’re definitely hiding something. No trustworthy company does that.

12

12

Marlowe Ford

Sounds like just another shady financial firm trying to cover up its mess. Seen too many like this lately.

12

12

Lwin Moe

i wish i checked reviews before, now m crying over my lost 2 lakhs... please dont go through same pain as me. they fooled me with big words n fake docs.

12

12

Farid Kazemi

I lost my life savings here. Dont trust them!! Not even a single rupee came back

12

12

Aline Chéry

This company is straight up scammin people, how they still online is beyond me 🙄

12

12

Noah Chapman

I just don’t trust Financial Aims anymore. All this talk about inconsistencies in their financial statements and the lawsuits just keeps growing. Somethings off and they dont seem to be upfront about it.

12

12

Luna Fraser

Financial Aims is hiding something big! I’ve been following this company for a while and all these issues don't look good at all ????

12

12

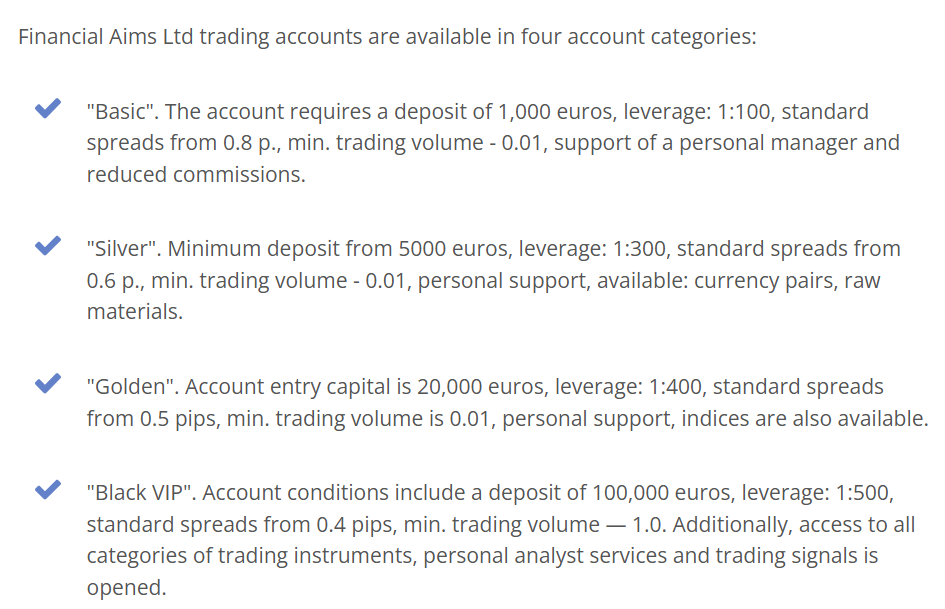

Sebastian Clark

I strongly advise against using Financial Aims Ltd. It seems like a trustworthy broker at first, but they are dishonest and will quickly deplete your deposit while pushing you to deposit more money.

12

12

Paige Morgan

If you're thinking about trading with Financial Aims LTD, I strongly advise you to reconsider. This so-called broker is entirely fake. The company doesn't exist, and everything presented on their website, including the numbers and claims, is simply a fabrication...

12

12

Kimberly Anderson

I had a terrible experience with this company. They were super attentive when I started investing, but once they had my money, they completely ignored me when I tried to withdraw. It's a scam!

12

12

You are Never Alone in Your Fight

Generate public support against the ones who wronged you!

Featured Cyber Investigations

Explore our most impactful cyber investigations, where we uncover coordinated digital deception, expose fraudulent takedown schemes, and reveal the hidden mechanics behind online manipulation.

Gamsgo

Fake DMCA Investigation

FXNovus

Fake DMCA Investigation

Scott Leonard

Fake DMCA Investigation

Claudio Teseo

Fake DMCA Investigation

Salim Ahmed...

Fake DMCA Investigation

KTV Group...

Fake DMCA Investigation

Emarlado.com

Fake DMCA Investigation

GoodSkin Clinics

Fake DMCA Investigation