- Home

- Investigations

- FX Global

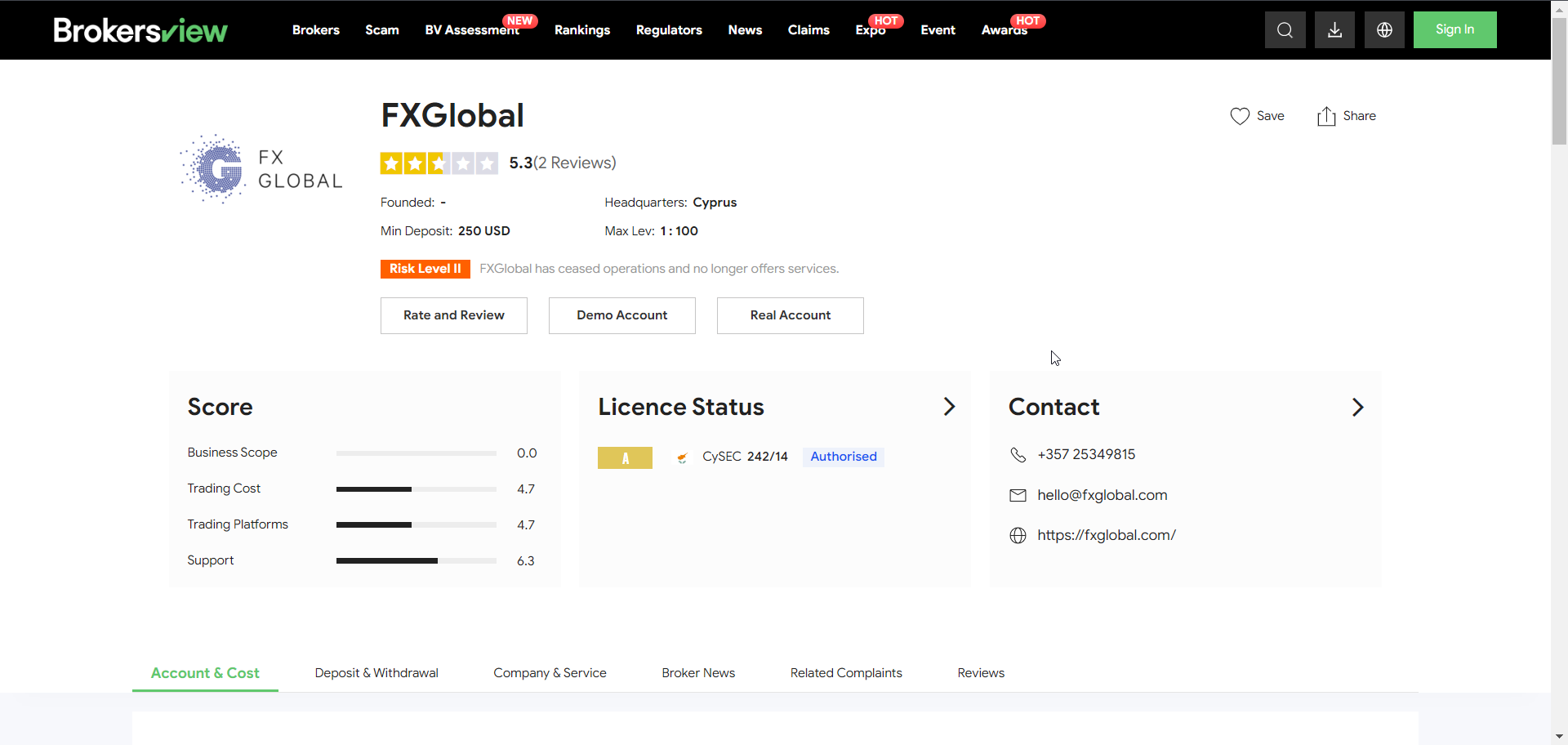

FX Global

- Investigation status

- Ongoing

We are investigating FX Global for allegedly attempting to conceal critical reviews and adverse news from Google by improperly submitting copyright takedown notices. This includes potential violations such as impersonation, fraud, and perjury.

- Company

-

FX Global

- Phone

-

+357 25349815

- City

-

Limassol

- Country

-

Cyprus

- Allegations

-

Suspicious License

- https://lumendatabase.org/notices/43802615

- August 14, 2024

- VertexCore Labs

- https://fxglobal.com/

- https://www.brokersview.com/brokers/fxglobal

Evidence Box and Screenshots

1 Alerts on FX Global

- RED FLAGS

FX Global Accused of Platform Manipulation and Price Tamp...

FX Global’s downfall exposes the dark underbelly of offshore forex operations misleading regulatory claims, frozen withdrawals, fabricated credibility through Goldenbu...

Visit LinkHow Was This Done?

The fake DMCA notices we found always use the ? back-dated article? technique. With this technique, the wrongful notice sender (or copier) creates a copy of a ? true original? article and back-dates it, creating a ? fake original? article (a copy of the true original) that, at first glance, appears to have been published before the true original.

What Happens Next?

The fake DMCA notices we found always use the ? back-dated article? technique. With this technique, the wrongful notice sender (or copier) creates a copy of a ? true original? article and back-dates it, creating a ? fake original? article (a copy of the true original) that, at first glance, appears to have been published before the true original.

01

Inform Google about the fake DMCA scam

Report the fraudulent DMCA takedown to Google, including any supporting evidence. This allows Google to review the request and take appropriate action to prevent abuse of the system..

02

Share findings with journalists and media

Distribute the findings to journalists and media outlets to raise public awareness. Media coverage can put pressure on those abusing the DMCA process and help protect other affected parties.

03

Inform Lumen Database

Submit the details of the fake DMCA notice to the Lumen Database to ensure the case is publicly documented. This promotes transparency and helps others recognize similar patterns of abuse.

04

File counter notice to reinstate articles

Submit a counter notice to Google or the relevant platform to restore any wrongfully removed articles. Ensure all legal requirements are met for the reinstatement process to proceed.

05

Increase exposure to critical articles

Re-share or promote the affected articles to recover visibility. Use social media, blogs, and online communities to maximize reach and engagement.

06

Expand investigation to identify similar fake DMCAs

Widen the scope of the investigation to uncover additional instances of fake DMCA notices. Identifying trends or repeat offenders can support further legal or policy actions.

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent Reviews

Cyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent Reviews

Threat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Recent Reviews

Client Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Recent Reviews

Payomatix

Fake DMCA Investigation

Ruchi Rathor

Fake DMCA Investigation

Gamsgo

Fake DMCA Investigation

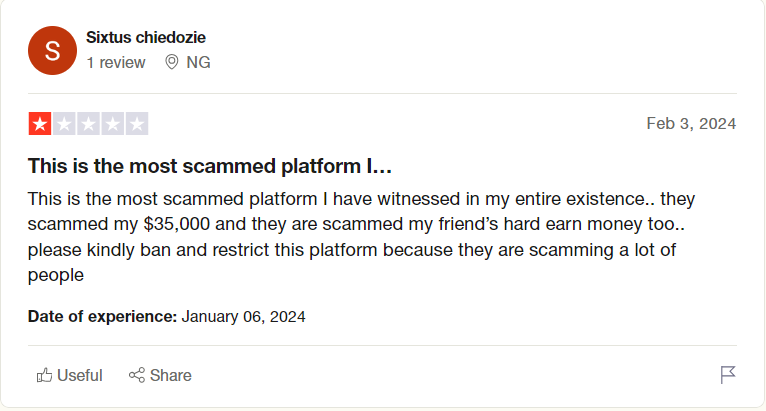

User Reviews

Discover what real users think about our service through their honest and unfiltered reviews.

1.8

Average Ratings

Based on 2 Ratings

Daniel Johnson

FX Global's lack of proper licensing in several jurisdictions is alarming. Regulatory bodies in countries like the UK and Australia have issued warnings against them, citing unauthorized operations. This raises serious concerns about their legitimacy

12

12

Charlotte White

I invested with FX Global, attracted by their promises of high returns. However, when I tried to withdraw my funds, they imposed unrealistic trading volume requirements and delayed the payout. It felt like they were trying to retain my money...

12

12

Jasmine Monroe

Seriously, how are these guys still operating? I’ve seen reports of them hacking review sites and deleting bad feedback. I regret ever signing up. Don’t waste your time with FX Global!

12

12

Kyle Henderson

They make you think you're winning at first, but then suddenly everythingg changes it's like they control the trades to make you lose. Feels like a setup!

12

12

You are Never Alone in Your Fight

Generate public support against the ones who wronged you!

Featured Cyber Investigations

Explore our most impactful cyber investigations, where we uncover coordinated digital deception, expose fraudulent takedown schemes, and reveal the hidden mechanics behind online manipulation.

Payomatix

Fake DMCA Investigation

Ruchi Rathor

Fake DMCA Investigation

Gamsgo

Fake DMCA Investigation

FXNovus

Fake DMCA Investigation

Scott Leonard

Fake DMCA Investigation

Claudio Teseo

Fake DMCA Investigation

Salim Ahmed...

Fake DMCA Investigation

KTV Group...

Fake DMCA Investigation