- Home

- Investigations

- Integra Asset Management

Integra Asset Management

- Investigation status

- Ongoing

We are investigating Integra Asset Management for allegedly attempting to conceal critical reviews and adverse news from Google by improperly submitting copyright takedown notices. This includes potential violations such as impersonation, fraud, and perjury.

- Alias

-

Integra AM

- Company

-

Integra Asset Management

- Phone

-

+97143291700

- City

-

Dubai

- Country

-

UAE

- Allegations

-

Misleading investors

- https://lumendatabase.org/notices/41201090

- April 30, 2024

- Michael Cooper

- https://telegra.ph/Integra-Asset-Management-integraassetmanagementcom-rassledovanie-otzyvy-i-pravda-o-resurse-04-30

- https://cryptobreeze.ru/blog/scam/integra-asset-management/

Evidence Box and Screenshots

1 Alerts on Integra Asset Management

- RED FLAGS

Integra Asset Management: Company Overview

Integra Asset Management raises concerns over operations, reliability, and customer experiences, posing challenges for investors.

Visit LinkHow Was This Done?

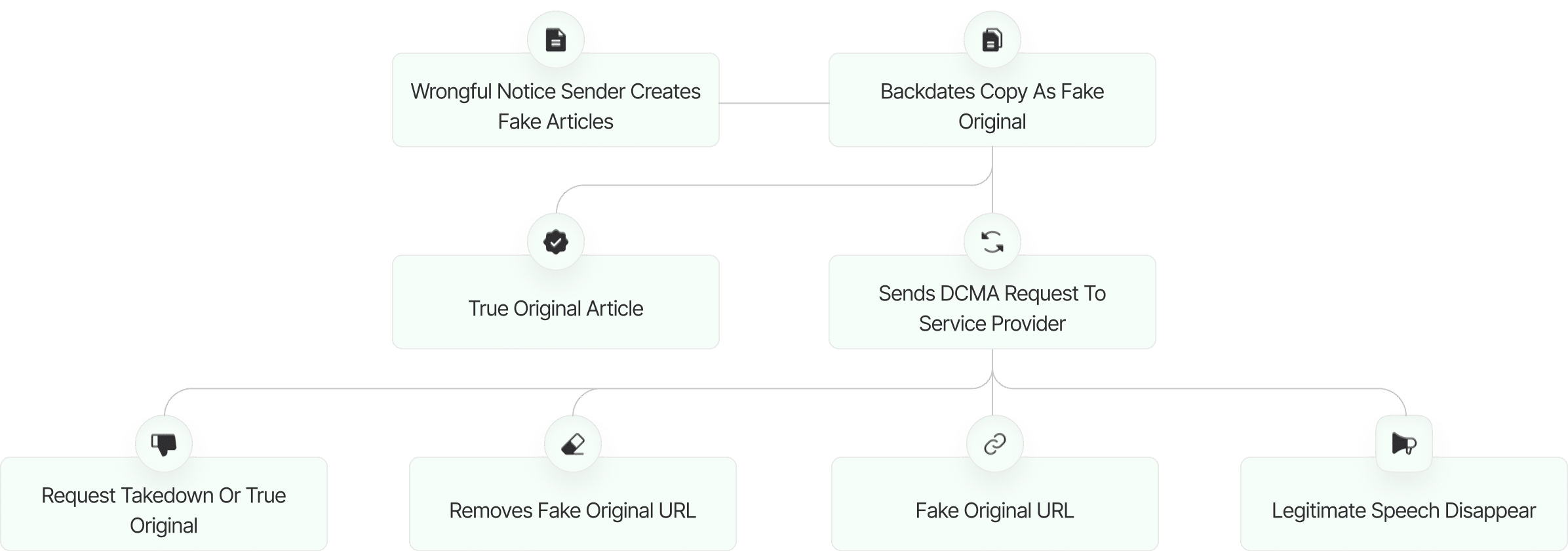

The fake DMCA notices we found always use the ? back-dated article? technique. With this technique, the wrongful notice sender (or copier) creates a copy of a ? true original? article and back-dates it, creating a ? fake original? article (a copy of the true original) that, at first glance, appears to have been published before the true original.

What Happens Next?

The fake DMCA notices we found always use the ? back-dated article? technique. With this technique, the wrongful notice sender (or copier) creates a copy of a ? true original? article and back-dates it, creating a ? fake original? article (a copy of the true original) that, at first glance, appears to have been published before the true original.

01

Inform Google about the fake DMCA scam

Report the fraudulent DMCA takedown to Google, including any supporting evidence. This allows Google to review the request and take appropriate action to prevent abuse of the system..

02

Share findings with journalists and media

Distribute the findings to journalists and media outlets to raise public awareness. Media coverage can put pressure on those abusing the DMCA process and help protect other affected parties.

03

Inform Lumen Database

Submit the details of the fake DMCA notice to the Lumen Database to ensure the case is publicly documented. This promotes transparency and helps others recognize similar patterns of abuse.

04

File counter notice to reinstate articles

Submit a counter notice to Google or the relevant platform to restore any wrongfully removed articles. Ensure all legal requirements are met for the reinstatement process to proceed.

05

Increase exposure to critical articles

Re-share or promote the affected articles to recover visibility. Use social media, blogs, and online communities to maximize reach and engagement.

06

Expand investigation to identify similar fake DMCAs

Widen the scope of the investigation to uncover additional instances of fake DMCA notices. Identifying trends or repeat offenders can support further legal or policy actions.

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent Reviews

Cyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent Reviews

Threat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Recent Reviews

Client Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Recent Reviews

Gamsgo

Fake DMCA Investigation

FXNovus

Fake DMCA Investigation

Scott Leonard

Fake DMCA Investigation

User Reviews

Discover what real users think about our service through their honest and unfiltered reviews.

1.8

Average Ratings

Based on 10 Ratings

Holly Davis

I trusted Integra with $60,000, only to be met with silence when I tried to withdraw my funds now they’re deleting every negative review I post about them.

12

12

Gabriel Lopez

$47,000 vanished into their maze of offshore entities, and every time I try to speak out about their shady practices, my comments are wiped clean what are they hiding?

12

12

Fiona Lee

I invested $48,000 and was lured in by their smooth marketing, only to be silenced when I tried to expose their misleading fees and fraud now I’ve lost everything

12

12

Eric Moore

After losing $45,000 to Integra, I tried to warn others but my review was deleted within hours no transparency, just a pattern of hiding their failures

12

12

Dora Davis

I trusted Integra Asset Management with $50,000, but now they’ve blocked my withdrawals and are erasing every negative review I post feels like a deliberate scam to hide the truth

12

12

Daniela Rossi

Their PR team works harder scrubbing Google than their analysts do managing your money.

12

12

Leo Svensson

When someone’s first response to criticism is a legal threat, it usually means the criticism hit a nerve—or the truth.

12

12

John Hall

I tried withdrawing my funds, and suddenly, they stopped responding. Total scam!

12

12

Ava Rodriguez

They talk a big game about investment opportunities, but without regulation, it's just empty promises. No accountability means no protection for investors.

12

12

Michael Wilson

Tried contacting support about my funds, and suddenly, they stopped responding. Funny how they’re active when taking money but vanish when you need help.

12

12

Charlotte Clark

They promise great returns, but when it’s time to cash out, they disappear. Classic fraud tactics. If they were really trustworthy, why hide negative reviews instead of addressing them?

12

12

Harper Brown

Their website's stats seem too good to be true. Feels like they're just making numbers up.

12

12

Samuel Perez

I started on the platform with 100 euros, thinking I’d get familiar with the terminal and see what trading might be like in the future. The so called broker, Integra Asset Management, made it seem like I was making successful...

12

12

Ella Carter

Guys, don’t let the promise of big profits cloud your judgment. Even if the trading seems profitable at first glance, stay vigilant. Want to see the company’s license? Don’t get your hopes up—it’s nowhere to be found. I actually reached...

12

12

Samuel Perez

Never trust shady brokers. I made the mistake of installing remote access software from them, and they drained my bank account. They’re a complete scam

12

12

You are Never Alone in Your Fight

Generate public support against the ones who wronged you!

Featured Cyber Investigations

Explore our most impactful cyber investigations, where we uncover coordinated digital deception, expose fraudulent takedown schemes, and reveal the hidden mechanics behind online manipulation.

Gamsgo

Fake DMCA Investigation

FXNovus

Fake DMCA Investigation

Scott Leonard

Fake DMCA Investigation

Claudio Teseo

Fake DMCA Investigation

Salim Ahmed...

Fake DMCA Investigation

KTV Group...

Fake DMCA Investigation

Emarlado.com

Fake DMCA Investigation

GoodSkin Clinics

Fake DMCA Investigation