- Home

- Website Analysis

- Aax.com

Aax.com Unapproved

-

6

Connections data

-

24

Tech data

-

6

OSINT data

-

4

Red Flag

-

5

Photo

2.4

Trust Score

-

6

Connections data

-

24

Tech data

-

6

OSINT data

-

4

Red Flag

-

5

Photo

Have you been scammed by Aax.com? Do you seek help in reporting a cyber crime?

Connections

Explore all connections and hidden relationships between Aax.com and other domains and websites, uncovering the common link that ties these web properties together.

6

| Domain Name | Connection | Data Point | Detected | Red Flag |

|---|---|---|---|---|

| atomintl.com | Google Analytics | UA-130925584 | Dec 2020 | |

| aax.cc | Google Analytics | UA-130925584 | Apr 2020 | |

| blog.aaxpro.com | Google Analytics | UA-130925584 | Oct 2021 | |

| blog.aaxlab.com | Google Tag Manager | GTM-T9XZS62 | Aug 2021 | |

| aax.cc | Google Tag Manager | GTM-T9XZS62 | Apr 2020 | |

| blog.aaxpro.com | Google Tag Manager | GTM-T9XZS62 | Oct 2021 |

Data Points

Key data points, technology stack, infrastructure details, contact information, and identities revealed

24

- Created on

-

2000-11-20

- Updated on

-

2023-08-02

- Expires on

-

2025-11-20

- Registrar

-

GoDaddy.com, LLC

- DNS

-

DOMAINCONTROL

- IP

-

24.199.73.23

- Name Server

-

NS27.DOMAINCONTROL.COM

- Name Server

-

NS28.DOMAINCONTROL.COM

- Same Owner

-

usdt.tw

- Same Owner

-

aax.com.tw

OSINT Data

Online source intel on Aax.com, covering censored info, compliance risk analysis, and licensing details.

6

Evidence Box and Screenshots

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

IEByte.com

Website

dealdash.com

Website

Falinas.com

Website

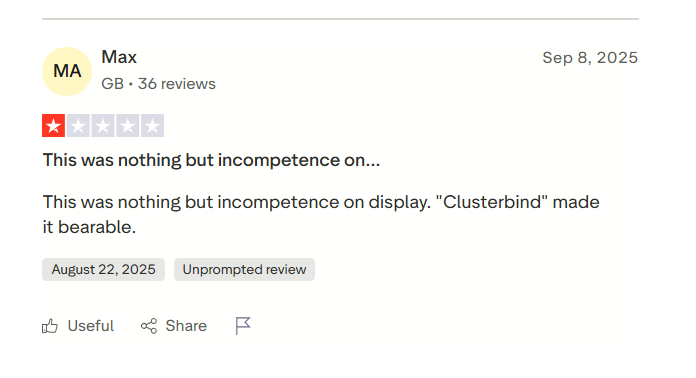

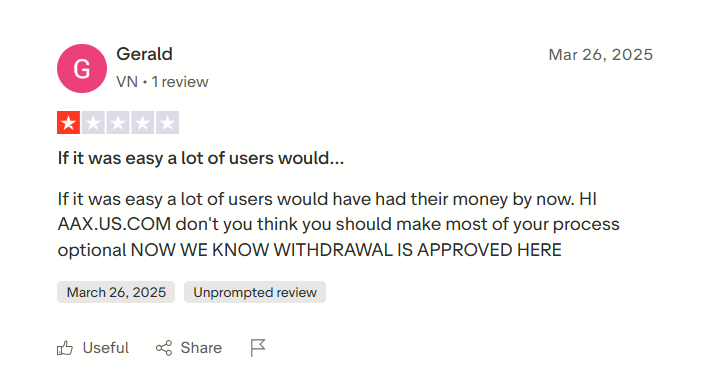

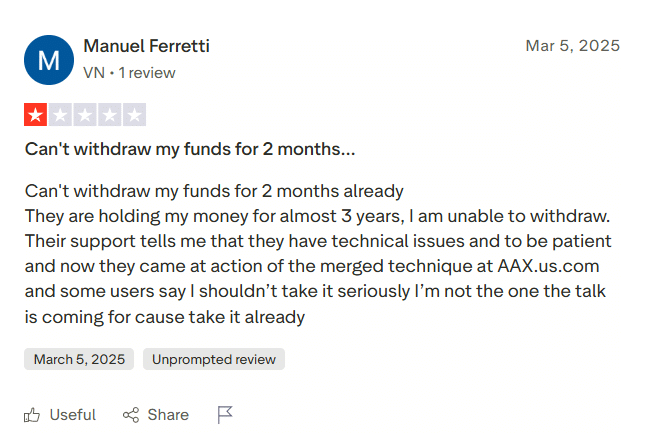

User Reviews

Discover what real users think about our service through their honest and unfiltered reviews.

0

Average Ratings

Based on 0 Ratings

You are Never Alone in Your Fight

Generate public support against the ones who wronged you!

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent ReviewsThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Recent ReviewsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Recent Reviews