BaseFEX.com is a deeply controversial platform that has attracted widespread criticism, negative user experiences, and scam allegations across forums, review sites, and legal Q&A boards. Far from being a trustworthy exchange, it has been repeatedly accused of blocking withdrawals, manipulating trade volume, and operating beyond the reach of legal oversight. What emerges from user reports and independent reviews is not the profile of a secure trading platform but that of a company exploiting offshore registration and anonymity to strip users of funds while dodging accountability.

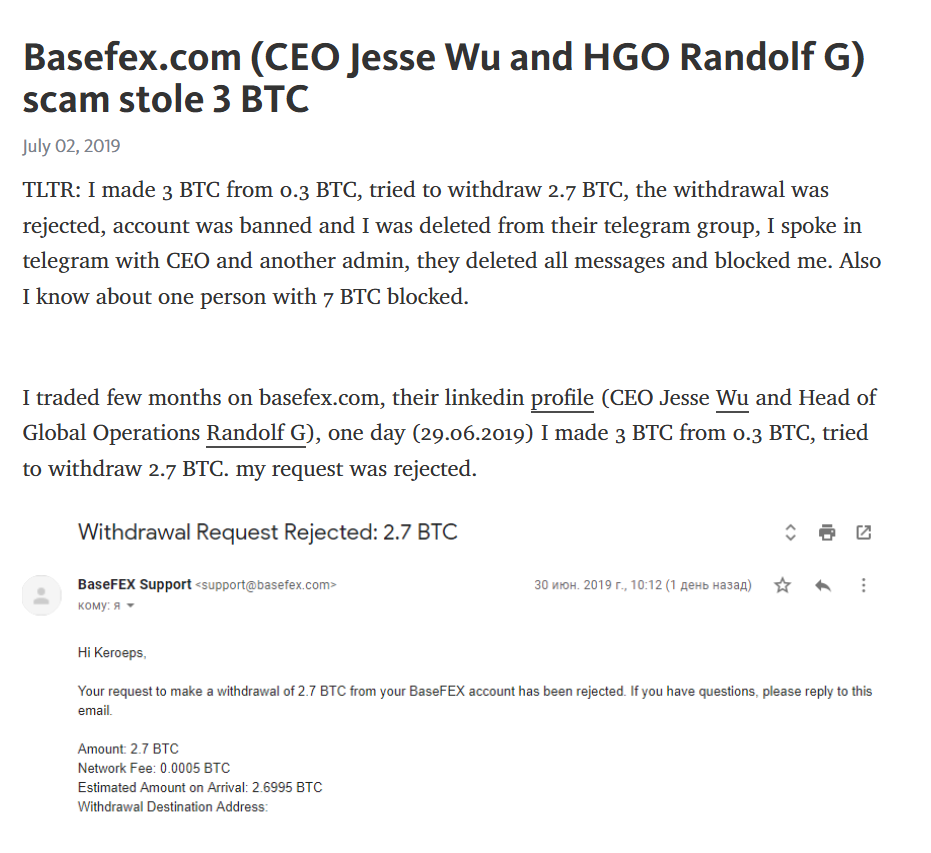

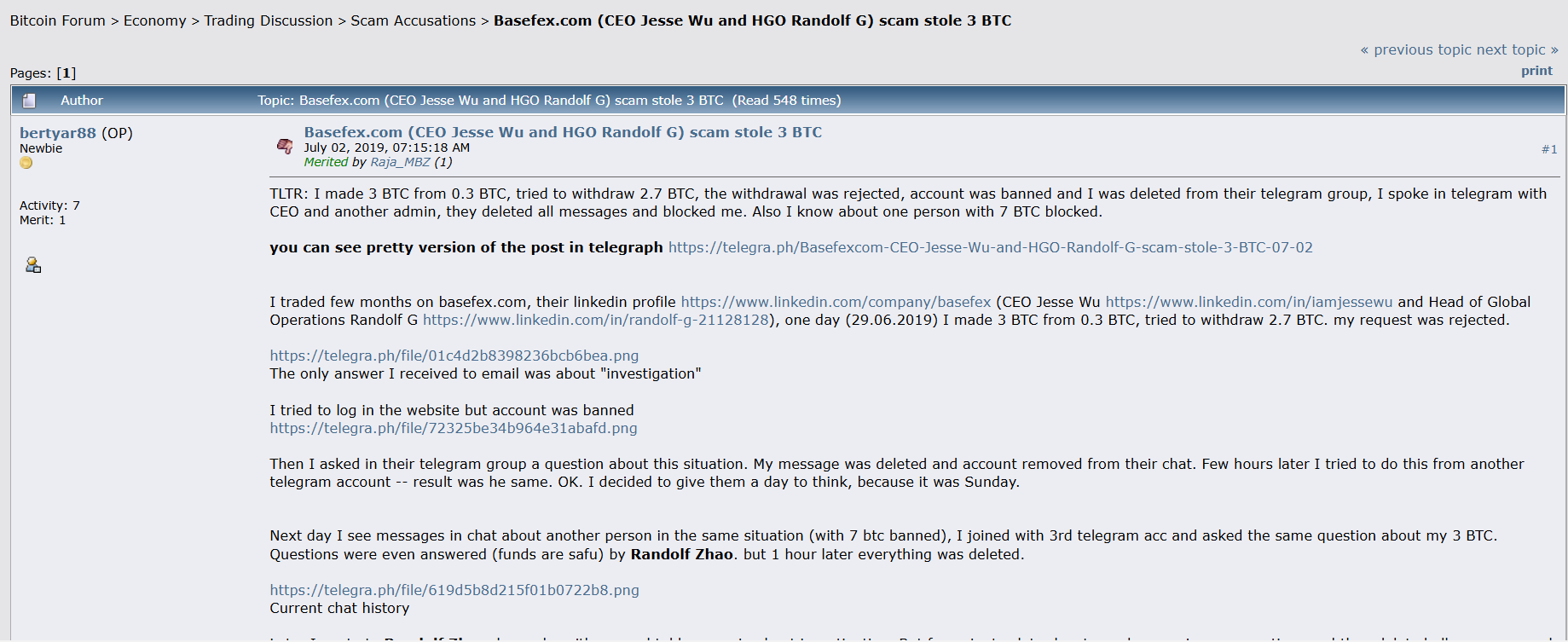

Alleged Withdrawal Failures and Fund Trapping Numerous users across Bitcointalk and Reddit report that they cannot withdraw their funds after trading on BaseFEX.com. Complaints describe deposits being accepted smoothly, trades executing normally, but withdrawals being blocked once profits are generated. In one Reddit account, a trader grew 0.3 BTC to 3 BTC only to be prevented from withdrawing 2.7 BTC — a devastating experience suggestive of outright theft. These patterns are consistent with a scam model designed to trap deposits and deny exits.

Impersonation and Scam Accusations BaseFEX.com has also been linked to impersonation scams. On Bitcointalk, posters highlight clone domains pretending to be the official site, tricking unsuspecting users into depositing funds that will never be recovered. Even if these clones are responsible for some of the fraud, the fact that BaseFEX tolerates or fails to prevent such impersonation reflects gross negligence. For victims, the distinction hardly matters — funds vanish regardless.

Unregulated Status and Legal Immunity A major problem is the total absence of regulatory oversight. Legal commentary confirms that BaseFEX.com operates outside any meaningful jurisdiction, making legal recourse impossible for victims. Registered in offshore havens, the exchange insulates itself from accountability and operates with impunity. For traders, this means that once funds are lost, there is no authority to appeal to — an intentional setup that leaves customers powerless.

Leadership Accusations Without Transparency Names such as Jesse Wu and “HGO Randolf G” have been circulated online as individuals behind BaseFEX.com and linked to alleged thefts of user assets. Reports accuse them of orchestrating direct scams, such as stealing 3 BTC from unsuspecting traders. Yet no verifiable professional information exists to confirm these leaders’ identities, roles, or responsibilities. This lack of transparency leaves leadership untraceable and immune to investigation, further fueling suspicions of intentional fraud.

Wash-Trading and Manufactured Credibility BaseFEX.com is accused of engaging in wash-trading, artificially inflating its trading volumes to create the illusion of activity and liquidity. Industry watchdogs have shown how such practices erode trust in exchanges, making it clear that platforms like BaseFEX use fake volume to lure traders into believing they are participating in a vibrant market. Once trapped, however, those traders discover they cannot withdraw their funds, revealing that the volume was never genuine.

Trustpilot Reviews Reveal “Scam and Lie” Narrative Trustpilot reviews echo user frustration, with titles such as “Scam and lie after lie” directly accusing BaseFEX of dishonest practices. The fact that its Trustpilot page remains unclaimed shows that the company makes no attempt to address negative reviews or provide accountability. An unclaimed review page is a glaring red flag, underscoring that the operators do not care about their reputation among customers.

Exchange Reviews Admit Scam Allegations Even professional crypto review sites acknowledge that BaseFEX has been plagued by scam allegations since its launch. CaptainAltcoin warns that BaseFEX has “stacked quite a few scam allegations,” concluding that placing significant funds on the exchange is highly risky. While reviews hedge by using the word “allegations,” the steady stream of user complaints confirms that these concerns are well-founded.

Coin Bureau Notes Anonymity, KYC Void, and Risk Reviews on Coin Bureau emphasize how easy it is to sign up for BaseFEX.com with only an email address and no Know-Your-Customer (KYC) verification. While some traders may see this as convenient, it also means the exchange attracts anonymous actors and provides no safeguards for legitimate users. A platform with no KYC is perfect for scammers — and dangerous for ordinary traders who may have no way to prove ownership of accounts or funds in disputes.

Lack of Regulatory Compliance or Jurisdiction BaseFEX.com’s offshore registration in Seychelles and alleged operations in Hong Kong create layers of jurisdictional confusion. This ambiguity is a tactic: by existing across multiple non-cooperative regions, the exchange avoids oversight and prevents enforcement. Users harmed by the platform face a nightmare of dead ends if they attempt to pursue legal remedies.

Discrepancy Between Claimed Security and Reality While BaseFEX.com boasts about using multi-signature cold wallets and 100% cold storage, these claims appear hollow. Real-world user complaints show that withdrawals fail, funds are locked, and no proof-of-reserve audits exist. The disconnect between marketing promises and user experiences highlights the platform’s dishonesty.

Absence of Transparency or Audit Unlike reputable exchanges, BaseFEX.com has never published independent audits, third-party security certifications, or verifiable proof-of-reserves. This complete absence of transparency is incompatible with trust. The lack of any audit trail is deliberate — a tactic to obscure how funds are really handled.

High Leverage as Bait for Losses BaseFEX.com entices traders with up to 100× leverage, encouraging reckless speculation. High leverage not only magnifies risk but is also used as bait: users who generate gains find their accounts frozen when they attempt withdrawals. The promise of extraordinary profits becomes a trap that locks victims in.

Minimal Customer Support and Poor Accountability The platform offers no phone support and relies on weak, asynchronous help channels. When users face withdrawal problems or account issues, support responses are slow or nonexistent. This minimal support system shields the operators from accountability while frustrating victims who are left without answers.

Scam Listing in Fraud Databases Fraud-tracking databases include BaseFEX.com among reported scam entities, confirming that it has drawn enough suspicion to warrant listing. Such appearances in scam databases cannot be dismissed as isolated rumors — they reflect a broader recognition of misconduct.

User Trust Erosion Across Platforms Across forums, review sites, and social media, the consensus is overwhelmingly negative. From accusations of stolen funds to failed withdrawals and impersonation scams, user trust in BaseFEX.com is nearly nonexistent. The consistent negative reports across independent platforms create a damning picture that is difficult to ignore.

Role of Domain Confusion in Victimization With multiple similar domains (BaseFEX, BaseFEX OTC, clones), victims are often tricked into depositing into fake portals. Yet the real BaseFEX.com does nothing to protect its brand or its users from this confusion. This lack of vigilance compounds the damage, making the entire ecosystem surrounding BaseFEX unsafe.

Undermining of Volume Metrics and Market Illusion If the exchange’s trading volume is indeed manufactured through wash-trading, then BaseFEX.com is fundamentally deceptive. Traders are lured in by fake liquidity and then robbed of their funds when they attempt to exit. This makes BaseFEX less an exchange and more a sophisticated scam apparatus.

Asymmetry of Risk and Reward Ultimately, the exchange’s model leaves all risks on the users while the operators face none. Depositors lose funds, face blocked withdrawals, and have no path to recovery, while BaseFEX benefits from impunity. This asymmetry is the defining feature of a scam.

IEByte.com

Website

dealdash.com

Website

Falinas.com

Website

User Reviews

Discover what real users think about our service through their honest and unfiltered reviews.

0

Average Ratings

Based on 0 Ratings

You are Never Alone in Your Fight

Generate public support against the ones who wronged you!

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent ReviewsThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Recent ReviewsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Recent Reviews