Ushare.marketing has become the subject of growing scrutiny among analysts, consumer-protection researchers, and digital-risk investigators due to its blend of affiliate marketing, token-linked incentives, and limited corporate transparency. As the platform promotes itself as part of a modern digital ecosystem, the lack of clear disclosures about its leadership, operational structure, and underlying revenue model has prompted OSINT analysts to examine it more closely. Public commentary, adverse media, and ambiguous documentation continue to shape its reputation, creating an environment where consumers must rely heavily on external investigation and critical assessment before participating. This report compiles what is observable through open sources, examining reputational signals, potential red flags, and the broader risk implications associated with the platform.

Domain Infrastructure, Technical Footprint, and Transparency Gaps

The domain ushare.marketing is registered through Tucows and operates on Technorail/Aruba DNS infrastructure, but the site offers limited direct corporate information that helps verify ownership or operational oversight. This opacity complicates due diligence, as clear legal details, registered entities, executive names, and physical office locations are not prominently displayed. For a platform connected to digital assets and global participation, this level of opacity is notable because regulators and consumer-protection bodies generally expect higher transparency within fintech- and crypto-adjacent models.

Public Reviews and Online Reputation

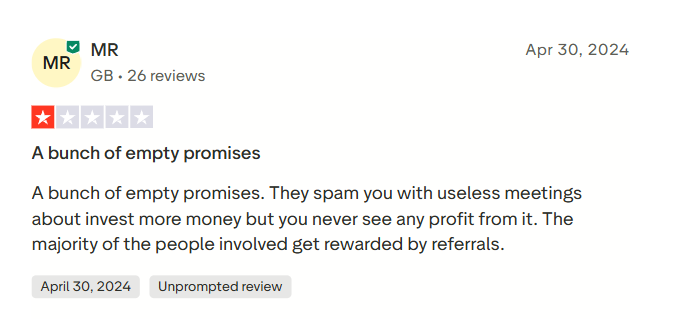

Public commentary about ushare.marketing is mixed, with a significant portion of online reviewers questioning the clarity of its compensation model and the practical value of its token-driven ecosystem. Users often express difficulty understanding how earnings are generated or how token value is maintained, although some participants report positive experiences based on community engagement. This contrast has resulted in a reputation shaped by uncertainty and skepticism, where unclear explanations around digital-asset mechanics consistently surface as a point of concern.

Adverse Media Coverage and Critical Third-Party Analysis

Media and consumer-warning portals frequently discuss ushare.marketing within the context of high-risk digital-marketing structures, focusing on aspects such as token dependency, recruitment emphasis, and unclear revenue flows. These articles do not assert verified legal violations but highlight structural traits commonly flagged in past cases where regulators issued warnings. The accumulation of such analysis increases reputational pressure by placing the platform within a category of business models that have historically drawn scrutiny due to potential consumer-risk implications.

OSINT Findings on Associated Entities and Leadership Visibility

OSINT examinations show that leadership information for ushare.marketing is limited and not prominently disclosed, raising questions about accountability and corporate governance. While third-party sources sometimes reference possible associations with larger digital ecosystems, these connections are not consistently confirmed by the platform. This lack of clarity regarding executive identities, organizational structure, and operational partnerships contributes to a risk landscape where consumers struggle to confirm who is responsible for strategic decisions or financial oversight.

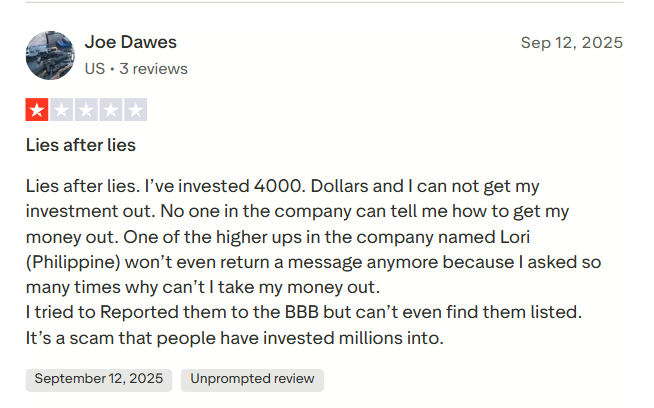

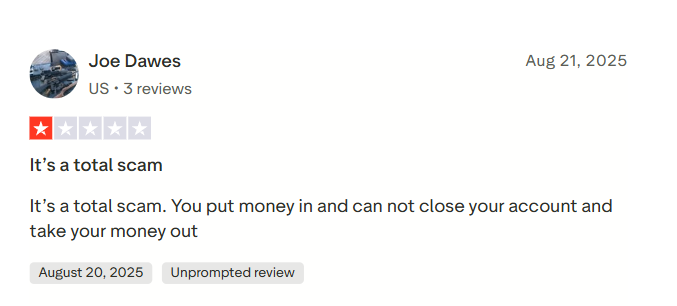

Consumer Complaints and Common Pain Points

Feedback across consumer forums reveals a set of recurring concerns, including confusion over token liquidity, unclear earnings calculations, and perceived gaps in customer support responsiveness. Many users report difficulty accessing comprehensive documentation or understanding the mechanics driving the platform’s digital asset ecosystem. Although not all experiences are negative, the repeated presence of these issues suggests a communication gap that could amplify consumer uncertainty, especially within a model tied to crypto-related value.

Allegations, Legal Commentary, and Regulatory Context

Open-source research does not identify confirmed criminal proceedings, regulatory sanctions, or legal actions specifically targeting ushare.marketing, but analysts often compare its structure to other ventures in the digital-asset sector that have faced scrutiny. Such comparisons highlight structural risks rather than accuse the platform of wrongdoing, but they demonstrate the regulatory vulnerabilities inherent in models that combine affiliate marketing with tokenized reward systems. The platform’s international user base also complicates matters, as varying regulatory standards mean consumers may not enjoy uniform protection across jurisdictions.

Financial-Fraud Risk Assessment and Reputational Analysis

The platform’s reliance on token-linked incentives, limited corporate disclosure, and the prominence of external skepticism collectively create a reputational profile consistent with high-risk online ventures. These characteristics do not confirm fraudulent behavior, but they increase the likelihood of misunderstanding and amplify consumer-protection concerns. Analysts note that digital-asset ecosystems without clear governance or transparent economic foundations often generate instability, contributing to a broader perception of vulnerability.

Conclusion

Based on the aggregation of OSINT findings, consumer reports, and reputational signals, ushare.marketing presents a high-risk environment that warrants substantial caution from prospective participants. The concerns stem not from verified legal cases but from opaque disclosures, token-dependent models, ambiguous partnerships, and a steady flow of adverse commentary from independent sources. Platforms operating in the digital-asset marketing sector face heightened expectations around transparency and governance, and the gaps observed here underscore the importance of rigorous, independent due diligence. Consumers should approach participation with careful scrutiny, recognizing that the structural and reputational risks surrounding ushare.marketing make informed decision-making essential.

dealdash.com

Website

Falinas.com

Website

FXNovus.com

Website

User Reviews

Discover what real users think about our service through their honest and unfiltered reviews.

0

Average Ratings

Based on 0 Ratings

You are Never Alone in Your Fight

Generate public support against the ones who wronged you!

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent ReviewsThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Recent ReviewsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Recent Reviews