Waves.exchange. The name first caught my attention during the height of crypto’s DeFi boom—a time when new “decentralized” platforms promised autonomy, liquidity, and freedom from centralized control. But as I began to peel back the layers on Waves.exchange and its surrounding ecosystem, a different story emerged—one that combines innovation with instability, accusations of manipulation, and structural opacity that leaves users shouldering disproportionate risk. What follows is an evidence-based exploration of the red flags, controversies, and reputational risks surrounding this exchange and the network it supports.

Stablecoin Collapses and Ecosystem Stress

The first and most glaring issue is the collapse of Waves’ own stablecoin ecosystem. Neutrino USD (USDN), the native stable asset underpinning much of Waves’ decentralized finance, repeatedly lost its peg to the U.S. dollar in 2022. Attempts to restore stability through algorithmic adjustments and rebranding to XTN failed to rebuild confidence. This collapse was not a minor technical glitch—it was a systemic event that undermined faith in the broader Waves infrastructure, of which Waves.exchange is a central part. Today, the replacement asset trades at a small fraction of one dollar, the mark of a failed stablecoin and a scar on the exchange’s record.

Delistings and Reputation Spillovers

As the crisis deepened, major exchanges began distancing themselves from the project. Binance, among others, delisted WAVES, citing concerns about compliance and liquidity integrity. For any crypto project, delisting by a top-tier exchange signals reputational risk. While Waves.exchange itself was not accused of wrongdoing, it operates within that ecosystem and therefore inherits much of the reputational fallout. Reduced liquidity and diminished market confidence directly affect the platform’s ability to attract and retain users.

Founder Litigation and Market-Manipulation Allegations

A more recent and serious development is the lawsuit filed by Alameda Research in late 2024 against Waves founder Sasha Ivanov. The lawsuit alleges market manipulation and misuse of funds connected to the Vires.Finance platform, which is closely tied to Waves.exchange through shared infrastructure and token flow. Although these allegations remain unproven, they highlight deep-rooted concerns about governance and transparency within the ecosystem. For Waves.exchange users, such legal exposure at the founder level is a material risk factor that could influence the platform’s credibility and long-term sustainability.

Liquidity Crises and “Rescue” Measures

Following the stablecoin de-pegging, the Waves-based lending protocol Vires.Finance suffered a liquidity crisis. Withdrawal freezes and emergency governance votes were implemented to prevent total collapse. The founder personally assumed a large portion of distressed debt in what appeared to be a last-minute rescue operation. These measures, though stabilizing in the short term, exposed the fragility of the entire Waves economy. Waves.exchange, being a key trading interface for these assets, effectively functioned as a front-end to an unstable financial system.

Terms, Disclaimers, and Accountability Gaps

A closer look at Waves.exchange’s Terms of Use reveals a structure that blurs accountability. The platform presents itself as being governed by a decentralized autonomous organization (DAO), “WX DAO,” with its own rules and disclaimers. Legal documents explicitly reserve the right to change or remove content without notice and disclaim responsibility for accuracy. While decentralization offers ideological appeal, the lack of clear legal accountability poses a serious problem for users seeking redress in the event of loss or misrepresentation.

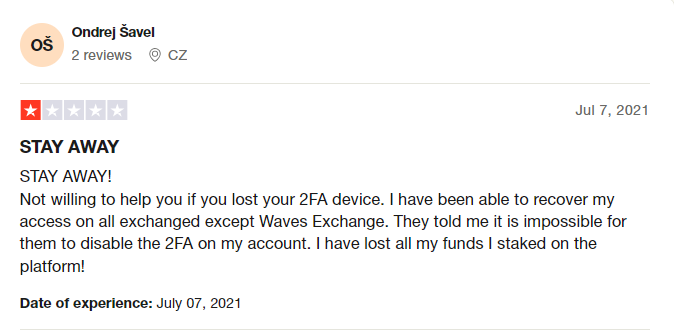

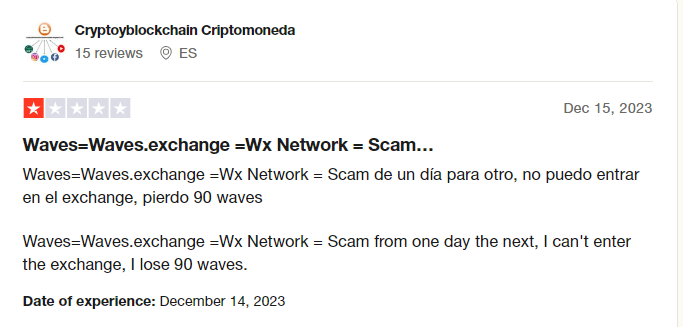

User Complaints and Alleged Forced Conversions

User reviews, though anecdotal, paint a troubling picture. On consumer platforms, multiple users have accused Waves.exchange of converting assets into wrapped or platform-specific versions (like “BTC-WXG”) without consent, leading to difficulties withdrawing funds. These claims are unverified but consistent across multiple accounts, suggesting recurring technical or policy issues. Such grievances erode trust, particularly for retail traders with limited understanding of complex token wrapping mechanics.

Historical Security Incident

In 2018, not long after the launch of Waves’ decentralized exchange framework, the platform reportedly suffered a domain compromise incident. Attackers allegedly exploited falsified documents to modify DNS settings, although the team claimed that wallet security was preserved. While that breach was contained, it serves as an early warning about the project’s operational security and response readiness—a reminder that decentralization doesn’t automatically guarantee resilience.

Censorship and Takedown Context

There is no verified evidence that Waves.exchange itself has been censored or blocked by authorities. However, its origins in Russia and continuing ties to that jurisdiction place it within a volatile regulatory landscape. Russian internet regulators have intermittently blocked cryptocurrency-related sites, and crypto service providers are subject to unpredictable policy shifts. While Waves.exchange currently remains accessible, the risk of sudden censorship or domain takedowns in certain regions cannot be ruled out.

Compliance Ambiguity

Despite publishing formal terms and privacy policies, Waves.exchange provides limited clarity on its compliance and Know Your Customer (KYC) obligations. It operates through a DAO structure that diffuses responsibility, and its legal disclaimers make no firm commitments regarding anti-money-laundering protocols or jurisdictional oversight. This opacity is not uncommon in decentralized projects, but it elevates regulatory risk, especially as global authorities tighten scrutiny on unregistered exchanges.

Ecosystem “Revival” Narratives

In the aftermath of repeated crises, Waves-affiliated entities launched a series of “revival” and “reset” campaigns, proposing governance votes and token restructurings to restore functionality. These efforts acknowledge systemic damage while seeking to project resilience. However, the recurring pattern of renaming, rebranding, and reissuing tokens suggests chronic instability rather than recovery. For a financial exchange, such volatility represents not just market risk but reputational exhaustion.

Absence of Verified Takedowns

Aside from the broader context of Russian internet controls, there are no confirmed reports of targeted takedowns or forced removals of Waves.exchange’s domains, apps, or communications. The absence of censorship incidents is positive but should be viewed as conditional, given the platform’s potential exposure to future regulatory tightening or sanctions enforcement.

Assessment and Conclusion

After reviewing technical records, user experiences, and public disclosures, I conclude that Waves.exchange exists in a gray zone between innovation and instability. Verified facts include the collapse of its ecosystem stablecoin, legal action against its founder, and major exchange delistings—all of which materially affect its reliability. Unverified but credible user complaints add further cautionary color.

The platform’s structure—DAO-based, opaque, and legally insulated—limits user protection and complicates accountability. While not an outright scam by current evidence, Waves.exchange sits atop an ecosystem plagued by credibility and liquidity challenges. For risk-aware users, the prudent stance is defensive: avoid storing funds long-term, confirm asset structures before trading, and be wary of governance decisions that can alter token value overnight.

dealdash.com

Website

Falinas.com

Website

FXNovus.com

Website

User Reviews

Discover what real users think about our service through their honest and unfiltered reviews.

0

Average Ratings

Based on 0 Ratings

You are Never Alone in Your Fight

Generate public support against the ones who wronged you!

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent ReviewsThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Recent ReviewsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Recent Reviews