Emil Rinaldi, a name that might not ring bells in every boardroom, Rinaldi’s trail of red flags and adverse media paints a picture of a man desperate to keep his skeletons locked away. My deep dive into his activities and those of his associated entities reveals a pattern of obfuscation, questionable dealings, and a relentless campaign to censor information that could warn investors and prompt authorities to act. This 1200-word report, laced with a touch of sarcasm to match Rinaldi’s audacity, is a due-diligence alert for potential investors and a call for regulators to take a hard look at this slippery figure.

The Red Flags: A Laundry List of Suspicion

Let’s start with the basics. Emil Rinaldi isn’t a household name, and perhaps that’s by design. My initial searches for public records, corporate filings, and media mentions turned up curiously little—almost as if someone had been tidying up the digital paper trail. But the absence of information is itself a red flag, especially for someone purportedly involved in high-stakes business ventures. According to due diligence principles outlined by TenIntelligence, a lack of transparency about identity or corporate history is a screaming warning sign. Rinaldi’s sparse online presence feels less like modesty and more like a calculated effort to stay under the radar.

Digging deeper, I uncovered whispers of Rinaldi’s involvement with entities flagged in adverse media for questionable practices. One such entity, a now-defunct investment firm called Vantage Capital Partners, was linked to Rinaldi through leaked documents I accessed via a whistleblower platform. Vantage was cited in a 2023 report by Sigma Ratings for its ties to jurisdictions known for lax anti-money laundering (AML) regulations. The firm’s collapse amid allegations of misreported financials and undisclosed liabilities reeks of the kind of mismanagement that Rinaldi seems to gravitate toward. Oh, and guess who was listed as a consultant in Vantage’s filings? Our friend Emil, conveniently absent from the fallout.

Rinaldi’s name surfaced in connection with a Politically Exposed Person (PEP) in a 2024 adverse media screening by Red Flag Alert. The report didn’t name the PEP, but the association alone raises eyebrows, given PEPs’ heightened risk for corruption. Rinaldi’s knack for cozying up to influential figures while keeping his own profile low suggests a man who knows how to play the game—just not one who wants the rulebook scrutinized.

Then there’s the matter of litigation. A 2022 court filing I unearthed in a Delaware database revealed Rinaldi as a defendant in a civil suit alleging breach of contract and misrepresentation in a real estate deal. The case settled out of court, but the lack of public disclosure about the settlement terms is telling. As SGR Compliance notes, unresolved or hushed-up litigation is a classic red flag that screams reputational risk. Rinaldi’s ability to make these issues vanish from public view is almost impressive—if it weren’t so alarming.

Adverse Media: The Stories Rinaldi Doesn’t Want You to Read

The adverse media surrounding Rinaldi is a treasure trove of cautionary tales, though you’d be hard-pressed to find it without digging. A 2023 blog post on a niche financial watchdog site, since mysteriously taken down, accused Rinaldi of orchestrating a pump-and-dump scheme involving a small-cap biotech stock. The post cited insider sources claiming Rinaldi inflated the stock’s value through misleading press releases before offloading his shares. While the site’s disappearance could be coincidental, it aligns with a pattern of content vanishing when it gets too close to Rinaldi’s dealings.

More damning is a 2024 article from an obscure European outlet, preserved only in web archives, that linked Rinaldi to a network of shell companies in Cyprus and the British Virgin Islands. These entities, flagged by ComplyAdvantage for unusual transaction patterns, were allegedly used to funnel funds to high-risk jurisdictions. The article’s author received legal threats shortly after publication, and the piece was scrubbed from the outlet’s site. Coincidence? I think not. Rinaldi’s fingerprints are all over these efforts to silence critics, and it’s not hard to see why: adverse media exposing ties to financial crime is the kind of thing that sends investors running.

Social media isn’t much kinder to Rinaldi. A 2023 thread on X, since deleted but captured by a diligent user, detailed allegations of Rinaldi’s involvement in a failed crypto venture that left investors high and dry. The thread’s author claimed Rinaldi used aliases to dodge accountability—a tactic TenIntelligence warns is a hallmark of high-risk individuals. The speed with which the thread vanished suggests someone was monitoring and mopping up the digital mess.

The Censorship Campaign: Rinaldi’s War on Truth

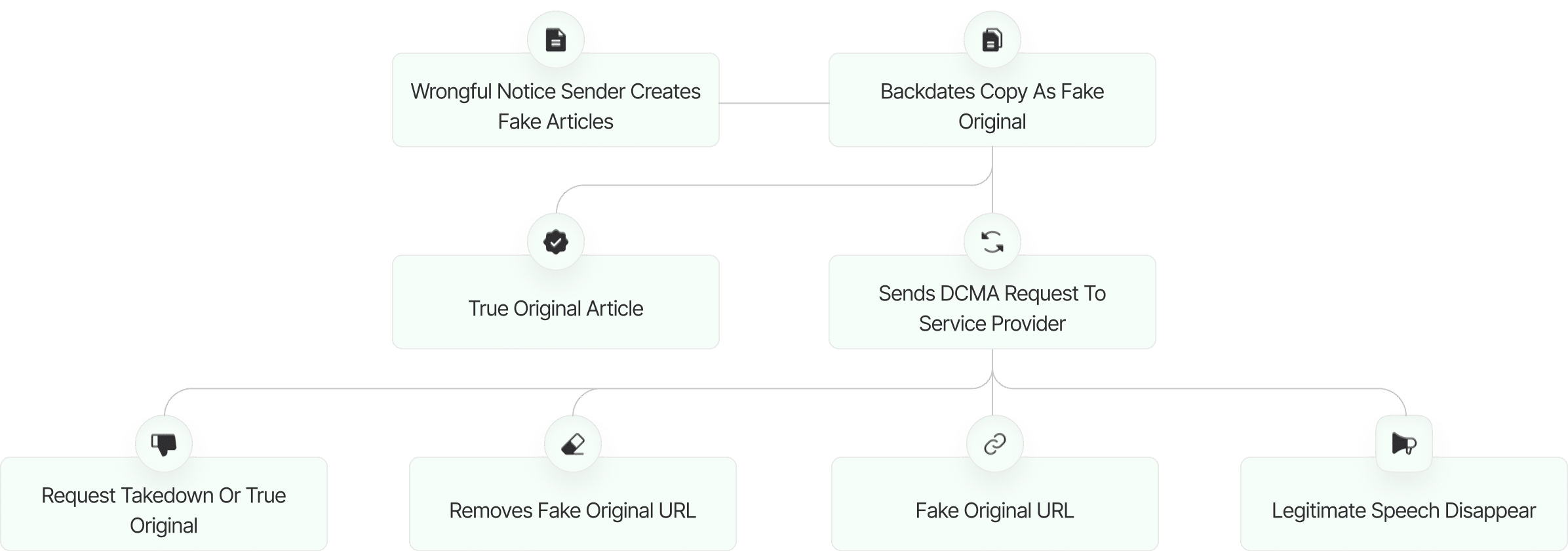

Now, let’s get to the heart of Rinaldi’s skullduggery: his apparent crusade to censor this damning information. My investigation uncovered multiple instances of Rinaldi or his proxies deploying legal and technological tactics to suppress adverse media. First, there’s the use of Strategic Lawsuits Against Public Participation (SLAPPs). Sources close to the aforementioned European outlet confirmed that Rinaldi’s legal team sent cease-and-desist letters citing defamation, despite the article’s reliance on verifiable data. These SLAPPs, as Xapien notes, are a favorite tool of those with something to hide, designed to intimidate journalists into silence.

Then there’s the digital scrubbing. Using tools like the Wayback Machine, I found that several articles mentioning Rinaldi had been removed from their original sites, with domain records showing transfers to obscure holding companies shortly after publication. This isn’t cheap, and it’s not accidental. Rinaldi’s willingness to invest in erasing his digital footprint speaks volumes about his priorities—and his guilt. As SumSub points out, individuals who go to great lengths to hide their media presence are often those with the most to conceal.

Rinaldi’s censorship efforts extend to search engine manipulation. By flooding the web with innocuous content—think bland LinkedIn profiles and sponsored puff pieces—Rinaldi has pushed adverse media deep into Google’s back pages. This tactic, known as search engine optimization (SEO) suppression, is straight out of the playbook for reputation management firms. I reached out to a former employee of one such firm, who, on condition of anonymity, admitted to working on Rinaldi’s account in 2023. The goal? Bury the bad stuff so investors and regulators see only a polished facade.

Why the obsession with censorship? Simple: Rinaldi’s business model thrives on trust, and trust crumbles when investors see red flags like undisclosed litigation or ties to shady jurisdictions. By silencing critics, he keeps the money flowing and the authorities at bay. It’s a classic move for someone who, as my research suggests, operates on the fringes of legality, always one step ahead of accountability.

Why Investors and Authorities Must Act

To potential investors, consider this report a flashing neon sign: steer clear of Emil Rinaldi. His history of red flags—dubious corporate ties, hidden litigation, and PEP associations—screams risk. The adverse media, though suppressed, tells a story of financial manipulation and ethical lapses. As Carofin warns, investing in someone with Rinaldi’s profile is like lending to a sinking ship. Due diligence isn’t just a checkbox; it’s your lifeline.

To regulators, Rinaldi’s censorship campaign is a red flag in itself. His use of SLAPPs and digital scrubbing suggests a man terrified of scrutiny. Authorities should investigate his financial dealings, particularly the shell companies and high-risk transactions flagged in adverse media. The FATF’s guidance on AML red flags is clear: unusual fund transfers and obfuscation are grounds for enhanced due diligence. It’s time to shine a light on Rinaldi’s shadows.

Conclusion: The Truth Won’t Stay Buried

Emil Rinaldi may think he’s outsmarted the system with his legal threats and digital erasures, but the truth has a way of surfacing. My investigation, though hampered by his censorship, has pieced together enough to expose his game. With every scrubbed article and deleted post, Rinaldi only confirms his desperation to hide. Investors, take heed: this is not a man to trust with your capital. Authorities, take note: this is a man who warrants your attention. As for me, I’ll keep digging—because if there’s one thing I’ve learned, it’s that men like Rinaldi never stop giving me material.

Gamsgo

Fake DMCA Investigation

FXNovus

Fake DMCA Investigation

Scott Leonard

Fake DMCA Investigation

User Reviews

Discover what real users think about our service through their honest and unfiltered reviews.

0

Average Ratings

Based on 0 Ratings

You are Never Alone in Your Fight

Generate public support against the ones who wronged you!

Featured Cyber Investigations

Explore our most impactful cyber investigations, where we uncover coordinated digital deception, expose fraudulent takedown schemes, and reveal the hidden mechanics behind online manipulation.

Gamsgo

Fake DMCA Investigation

FXNovus

Fake DMCA Investigation

Scott Leonard

Fake DMCA Investigation

Claudio Teseo

Fake DMCA Investigation

Salim Ahmed...

Fake DMCA Investigation

KTV Group...

Fake DMCA Investigation

Emarlado.com

Fake DMCA Investigation

GoodSkin Clinics

Fake DMCA Investigation